It's a domino effect. The American subprime crisis led a global financial crisis, then triggering an economic crisis. What's next, an employment and credit card debt crisis?

Both overseas and Chinese economists and bankers alike have started to consider the possibilities that may lead to another crisis in the global economies in 2009.

Guangdong Development Bank, a Guangdong based commercial bank that took the pioneering step among its domestic counterparts to design the first credit card for undergraduate students in 2004 is now refusing the students' applications for credit card, according to its new policy effective December 2008.

Guangdong Development Bank is not the only commercial bank that is backing away from the once sizzling market. China Merchants Bank, the leading credit card issuer, began saying "no" to undergraduates applying for credit cards in October 2008 and China Citic Bank stopped marketing credit cards to students at the beginning of 2008.

Chinese banks began to back off the business largely because the undergraduates have been blacklisted as high-risk cardholders after more borrowers defaulted on their payments in the wake of the financial crisis.

Accordingly banks have begun to tighten the standards for applicants.

China is not an exception. Banks in the United States are also taking measures to prevent a credit crisis. Big lenders, like American Express, Bank of America, Citigroup and even the retailer Target, have begun tightening standards for applicants and are culling their portfolios of the riskiest customers.

The New York Times reports that big lenders are slowing the flood of mail offers to a trickle with moves that would translate for the average American household into about 13 fewer pieces of credit card junk mail a year than its peak in 2005.

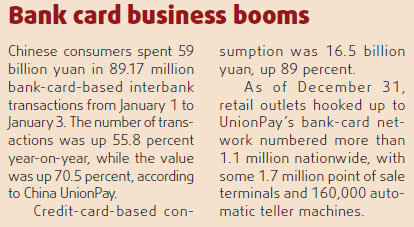

Compared with such a credit-hooked country as the US, China is still an emerging credit card market.

Xu Luode, president of?China Unionpay, said currently there are 47 banks that are allowed to issue credit cards and these banks have issued over 150 million credit cards till the end of 2008.

However, analysts forecast the financial crisis will raise the bad loan rate for credit cards to 3 or 4 percent, tripling the previous 1 percent level of the past two years.

Large amounts of cash withdrawn from credit cards through irregular means has also greatly contributed to the sharp rise in default rates.

In one such operation hucksters hand out cards with a "credit card service phone number" at subways. People who dial the number are directed to a private apartment where they can withdraw cash from their credit card through a Point of Service (POS) machine at a lower rate than banks.

The POS machines are easily obtained from banks, no matter it is true or false, under a pretense of being used for a business.

Under the circumstance, China Banking Regulatory Commission warned banks in June 2008 that they should be alert to fraud and credit risk posed by cardholders without stable incomes, including undergraduates.

Regulators were also urged to take action against the illegal use of credit cards, says Guo Tianyong, chairman of China Banking Research Center at Central University of Finance and Economics.

Banks such as China Merchants Bank and China Citic Bank have also found that after four or five years of credit card expansion, it's more profitable to maintain and cultivate customers with good credit than simply enlarging the number of users.

An anonymous sales manager at China Citic Bank told China Business Weekly that in 2009 it would focus on promoting its after-sale services and developing high-level customers who are more creditworthy and profitable, especially in light of the financial crisis.

"After five years of rapid expansion, the financial crisis gives us a chance to slow down and maintain our customers," the manager said. "Then we will be prepared to set out for another stage."

China Merchants Bank is echoing China Citic Bank in cultivating high-level customers.

Its new "Infinite Card" is designed for "VVIP" customers that are more worthy of an " Infinite" card than a "Diamond" or "Platinum" card.

One such Infinite Card theme card, "Astro Boy" targets the 35- to 40-year olds who enjoyed the "Astro Boy" cartoon when they were children and have achieved a stable financial status.

Industrial experts say though banks are tightening their standards they will return to expanding the market after the financial tsunami fades out.

The Bank of East Asia (BEA) has become the first locally incorporated foreign bank in China to issue credit cards on the mainland in December of last year.

Citibank, HSBC and Standard Chartered are also applying to issue yuan credit cards in China.

(China Daily 01/12/2009 page1)