Encouraged by the rollout of preferential national policies to promote outbound investments, Chinese enterprises are busy shopping for foreign mergers and acquisitions.

The question is whether this new enthusiasm will translate into the kind of success stories that will justify the strategy.

|

French designer Pierre Cardin 30 years ago became the first Western fashion designer to hold a fashion show in Beijing. This year, he is planning to sell his company's brand and licenses to Chinese entrepreneurs. CFP |

According to one survey by the China Council for the Promotion of International Trade earlier this year, only a third of the mergers and acquisitions by Chinese companies were considered successful.

"There have been few smart deals, as far as I know," said Thomas Chen, the China strategy director for Interbrand, an international brand consulting firm.

"The biggest problem is the majority (of entrepreneurs) have not decided what they expect to get from the deal. The offers are usually blind," Chen said.

Following this summer's reports that four Chinese businessmen will buy an unspecified stake in the French fashion company Pierre Cardin, analysts were quick to ask whether the buyers had the expertise to revive the luxury brand.

The purchase for an undisclosed price will allow the Chinese buyers to take over the brand and all business in China.

Following the news, a survey on Sina.com reported that 78.2 percent of Chinese consumers polled said they would not buy Pierre Cardin products after the takeover.

None of this has slowed outbound M&A activities by China's State-owned and privately owned enterprises.

New Jack Sewing Machine, a privately owned Chinese sewing machine provider from East China's Zhejiang province, took over two German sewing machine companies in mid-July at a cost of 45 million yuan.

The deal is China's first acquisition of overseas companies in the sewing machine sector.

The deal follows a series of firsts in other industries in recent months.

In early June, Tengzhong, a Chengdu-based industrial machinery maker, reached an agreement with General Motors Corp to buy the rights to its Hummer brand for an undisclosed price.

Suning Appliances, the country's leading electrical appliance retailer, announced in late June that it signed an agreement with Japanese electrical appliance retailer Laox.

Suning Appliances bought 27.36 percent of Laox's shares with an investment of $8.4 million, becoming its largest shareholder.

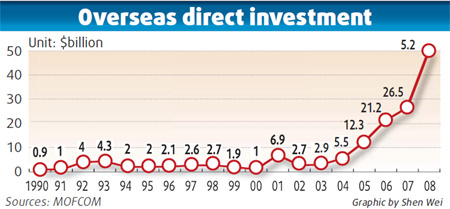

The growing interest in buying stakes in foreign companies is reflected in new statistics released by the Ministry of Commerce.

Through the end of June, overseas direct investment (ODI) surged by 43.5 percent year-on-year to 907 projects.

In May and June, the number of ODI deals totaled 547, up 173.5 percent from the same period last year.

Due to the unexpected failure in bidding for the Chinalco deal, the ODI in the non-financial sector by volume dropped by 51.7 percent from a year earlier to $12.4 billion.

In early June, Chinalco confirmed the collapse of the deal to invest $19.5 billion in Australia's Rio Tinto, the world's third-largest mining company.

That news did not detract from a positive outlook for ODI prospects through the rest of 2009.

"A number of State-owned and privately owned enterprises are showing a strong willingness to go overseas, and a large number of projects are under negotiation. The second half will be positive for ODI," said Yao Jian, a spokesperson for the Ministry of Commerce.

China's foreign exchange regulator, the State Administration of Foreign Exchange, lifted restrictions on ODI activities in mid-June.

The agency reported that more financial resources would be available to help Chinese companies finance outbound investments.

Earlier, the Ministry of Commerce shortened the approval process for such deals.

Those two actions will accelerate outbound investments this year, analysts said.

"The growth momentum will be stronger than last year," said Li Jianfeng, an analyst with Shanghai Securities.

From 2003 to 2008, China's ODI grew faster than in the previous two decades, and outbound investments from 2007 to 2008 doubled to almost $50 billion.

The nature of the investments is changing, too.

"Nowadays, obtaining technology and enlarging sales networks are what motivates many investors to go overseas," said Yao of the Ministry of Commerce.

Li said the country's growing foreign exchange reserves also are fueling more activity.

The "still gloomy economic situation in the United States" is among the reasons China is concerned about the stability of those reserves, he said.

China's foreign exchange reserves totaled $2.13 trillion at the end of June, up 17.84 percent year-on-year.

"To encourage qualified enterprises to go overseas at this time means to help China relieve the pressure," said Zhang Qizuo, vice-chairman of the China International Economic Research Institute.

Still, there has been resistance to some deals.

The failure of the Rio Tinto deal in June led analysts to suggest the Australian government was concerned that Chinalco, the world's largest steel producer would manipulate the price of iron ore.

Four years ago, the US government said no to a bid by China National Offshore Oil Co to buy Unocal, citing concerns over China's geopolitical influence.

On July 23, Beijing Automotive Industry Holding Co (BAIC) was excluded from bidding for General Motor's Opel unit, although the company had made the highest offer.

GM reportedly was worried about the possible direct competition launched by BAIC against the other units of its business in China.

"Chinese foreign investment efforts are encountering subtle resistance or outright discrimination by overseas governments and businesses," said Mike Balaban, founder and principal of US-based Balaban Associates, a China-focused consulting firm.

Even with successful bids, some observers question whether the buyers have done their homework.

"The acquisition of Thomson by TCL and the internationally publicized merger deal for IBM's PC business by Lenovo are examples," said Wu Ziaobo, a senior professor studying Chinese companies at Peking University.

"They are all unprofitable and costly businesses, which makes it a difficult task to give them new life," Wu said about IBM and Thomson.

Laox lost profits for nine consecutive years before Suning became its largest shareholder.

Now analysts are voicing concerns about whether Suning can turn Laox into a success story.

(China Daily 08/03/2009 page1)