|

CHINA> Top News

|

|

Investors urged to keep cool head on expo-related shares

By Wang Zhenghua (China Daily)

Updated: 2009-06-26 15:04

To buy or not to buy, that is the question. Stock trader Shen Faxiang does not see dollar signs coming out of the Shanghai Expo cash box that other investors are betting on. "It's hard to say if the expo will bring you any good financial or investment opportunities," the veteran pundit said as he watched share prices flicker across a trading screen at Shenyin & Wanguo Securities Co in Shanghai. "In order not to fall into a trap, you should re-evaluate your portfolio after the share indexes shift 100 points in either direction." The Shanghai 2010 World Expo, which is just over 300 days away, is expected to stimulate China's economy, which has managed to sidestep the brunt of the global recession but is still reeling from a drop in exports.

Analysts did the same thing prior to last year's Beijing Olympics. Most anticipate that the expo, which is 10 times as long as the Summer Games and is expected to attract around 70 million visitors, will help investors reap relatively large gains. "The World Expo will promote economic growth and help the stock market prosper," Guosen Securities' chief strategist Tang Xiaosheng said in a research note. "(It) will become one of the most important investment focuses in the upcoming year.

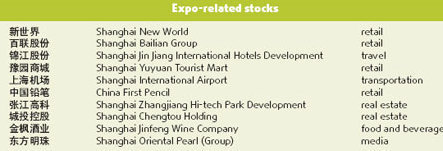

"In terms of the increase in the flow of people and logistics, the expo obviously outpaces the Olympics. The tremendous number of visitors will serve as the largest commercial opportunity during the exposition." Citing the lessons learned at previous world expos, for instance at Aichi 2005 in Japan, Changjiang Securities elaborated on how the city stands to benefit from staging the World's Fair. Direct investment in the expo and affiliated investment in the city's infrastructure will reach 286.7 billion yuan ($42 billion), ultimately contributing 430 billion yuan to Shanghai's economy, according to figures released by Changjiang. "There will definitely be an expo economy," Chen Xiwei said in a report by Guotai Jun'an Securities that was released last month. Consumer, travel, traffic and construction companies are widely expected to be the major beneficiaries. But word has yet to spread, or to be taken seriously, as evidenced by the quiet trading hall near People's Square in recent weeks, compared to the crowds that filled them for much of 2007. Two years ago, when stock trading exploded in China due to a red-hot equities market, the hall was stuffed with people from different wage and age brackets checking their share prices. Each self-service machine had to be shared by two or three retail investors, while a throng of gamblers waited in the wings to open new accounts. Outside, a group of tireless punters with barely any knowledge of the local stock market gathered from early afternoon until late at night listening to speeches by veteran investors. But now the crowds have thinned as the benchmark stock index stands at less than half of its peak from that period. Although many part-time traders have lost interest in the stock market since the Shanghai Composite Index hit rock bottom at 1,700 points last October, diehard investors have continued playing as they bid to cash in on the city's bright future. "The low-flying 2,000 to 3,000 points doesn't match our nation's strength," said Shen, who survives on zongzi (glutinous rice stuffed with different fillings) and other snacks as he burns the candles at both ends in the office. The full-blown construction craze that is swamping the city demonstrates officials' dream of turning Shanghai into an international financial and shipping center, said the 70-year-old, who sees stock trading as an antidote to burgeoning inflation. "In the 1960s you could feed the whole family for five yuan," he said. "But these days it's even difficult to do that on 100 yuan." Discussing the potential impact of the expo on the local stock market, pundits believe expo-related shares could suffer as investors snap up related shares in an abrupt move - another lesson learned from the 2008 Olympics. Past experience shows that China's stock market usually dances to its own beat, without regard to the broader economic situation. For much of this decade, Chinese stocks languished even as the domestic and global economy flourished. In 2006, the Shanghai index jumped 130 percent before doubling the following year as millions of new investors bet feverishly on quick returns. As shares fell back in 2008, many investors clung to the belief that the Chinese government would intervene to prop up the market before the Olympics, in an attempt to buoy the public's spirit and maintain stability ahead of the Games. It was a bet that never paid off. "It's silly to pump money into the equity market just because of the expo," said He Xinhua, who lost hundreds of thousands of yuan due to such miscalculations. "Investors should stick to the information disclosed by listed companies and other indexes such as the PE ratio," he added. The price to earnings (PE) ratio shows the value of a company's share price compared to its per-share earnings. By way of illustration, He discussed several shares that ballooned on the back of people's enthusiasm about the Beijing Olympics, then suddenly deflated when the event ended. "(Investors) should not blindly believe reports by securities firms," he said, suggesting that the firms do not always act impartially when advocating who to buy. Others are adamant there are short-term benefits to be gained. "These shares could still go up by 20 to 30 percent in the coming months," said one buyer, who gave his name as Shao. |

主站蜘蛛池模板: 国产一区二 | 在线播放国产视频 | 亚洲欧美国产高清va在线播放 | 欧美综合在线观看 | 欧美 亚洲 丝袜 清纯 中文 | 亚洲欧美日本韩国综合在线观看 | 国产精品特级毛片一区二区三区 | 亚洲精品一区专区 | a级毛片免费高清视频 | 亚洲悠悠色综合中文字幕 | 在线播放一区二区精品产 | 国产片一级aaa毛片视频 | 亚洲精品一区二区三区在线观看 | 亚洲国产二区三区 | 在线视免费频观看韩国aaa | 久久性精品 | 三级免费毛片 | 亚洲欧美国产一区二区三区 | 亚洲精品美女在线观看播放 | 牛牛a级毛片在线播放 | 在线欧美自拍 | 免费观看欧美一级高清 | 国产日韩欧美自拍 | 色伊人国产高清在线 | 久草福利在线观看 | 亚洲午夜久久久久影院 | 中文字幕欧美日韩一 | 亚洲天堂久久精品成人 | 日本阿v精品视频在线观看 日本阿v视频在线观看高清 | 中文字幕日韩一区二区 | 成人免费网站视频 | 久久久久久久国产a∨ | 久久久久久一级毛片免费野外 | 99国产精品视频免费观看 | 精品国产a| 在线观看日本www | 国产精品不卡无毒在线观看 | 欧美日一级| 国内美女福利视频在线观看网站 | 免费看操片 | 亚州综合|