Economy

ODI set to overtake FDI 'within three years'

By Ding Qingfen (China Daily)

Updated: 2011-05-06 06:58

|

Large Medium Small |

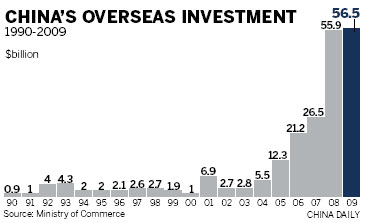

BEIJING - With an annual growth rate of "20 to 30 percent", outbound direct investment (ODI) will overtake foreign direct investment (FDI) "within three years", a senior Ministry of Commerce official said.

The United States, the European Union and Latin America are set to see "a rapid" increase in ODI from China, Zheng Chao, commercial counselor at the Department of Outward Investment and Economic Cooperation at the ministry, told China Daily.

|

||||

Earlier figures from the ministry suggested that ODI would take five years to pass FDI.

A report by the US Asia Society said that China's ODI is set to surge, with assets to reach between $1 trillion and $2 trillion worldwide by 2020.

ODI in the non-financial sector had reached $258.8 billion by the end of 2010, compared to $1.05 trillion for the total FDI figure over the last three decades, according to the ministry.

But the report also highlighted potential political obstacles, especially from the US Congress, which could have a "chilling effect" despite China doubling its investment there every year.

Global foreign investment shrank by 40 percent in 2009 thanks to the world financial crisis. But China's ODI in the non-financial sector increased by 6.5 percent to $43.3 billion that year. That saw China rise three places to ninth in the global investment league.

In 2010, China's ODI in the non-financial sector jumped 36.3 percent to $59 billion, a momentum that is predicted to continue.

"The transformation of China's economic development mode makes a pressing for companies to go overseas, either for technology or sales," Zheng said.

"It is risky for China to hold a large volume of foreign exchange reserves. The government should encourage Chinese companies to expand overseas and use the reserves to alleviate pressure."

China has focused on FDI since reform and opening-up. Its entry into the World Trade Organization in 2001 has seen ODI flourish.

"FDI has helped Chinese companies sharpen their competitive edge, making them better equipped to go overseas," said Lu Jinyong, director of the China Research Center for FDI at the University of International Business and Economics.

Investment into US

Overseas investment has mainly gone to the Asia-Pacific region and Oceania, but "the US, EU and Latin America will witness a rapid growth of investment from China", Zheng said.

According to the ministry, China's ODI in the US grew by 81.4 percent to $1.39 billion, and in the EU by 297 percent to $2.13 billion in 2010, from the previous year.

Meanwhile, its ODI in the ASEAN region and Australia rose by merely 12 and 20.5 percent. Investment in Japan surged by 120 percent.

US Commerce Secretary Gary Locke said on Wednesday the US should do more to attract investment from China.

But the US Asia Society report is not optimistic about prospects of Chinese investment in the US. It said the US believes that Chinese investment is largely driven by political reasons rather than the profit motive.

An executive from Huawei Technologies Co Ltd said the company is interested in expanding in the US, but restrictions due to political reasons are a major challenge.

Zheng said state governments in the US are showing growing interest in Chinese investment but "Congress isn't always welcoming".

China has invested in 35 of the 50 US states, with the largest investments in Texas, New York and Virginia.

China will urge the US to lift trade and investment barriers during the Third China-US Strategic and Economic Dialogue to be held in Washington next week.

In Africa the picture is less clear. Although Chinese investment in the continent has been rising, especially in the agriculture, infrastructure and natural resource sectors, Zheng said the prospects are "not as good as expected", because of possible political instability.

"More and more Chinese investment overseas will be realized through M&A (mergers and acquisitions). And State-owned enterprises will lead the way," Zheng said.

In 2010, China's overseas investment through M&A was $23.8 billion, or 40.3 percent of the total, compared with $19.2 billion and 34 percent in 2009. Most of the M&A projects are in the mining, manufacturing, and power supply sectors.

Private companies are also eyeing expansion overseas. Zhejiang-based Geely Holding Group, for instance, bought Volvo's car unit from Ford Motor Co for $1.8 billion last August.

"We are looking beyond the domestic market," said Teng Hexian, chairman of Beijing Runfar Investment Group.

"Capital is not an issue, but where and how to invest is a big problem."

Runfar, which has assets worth 3 billion yuan ($462 million), has invested in China's energy sector.

"There will be more cases like Geely, but private companies have to boost their management," Zheng said.