Banks bought more foreign currency than they sold in Dec

China's foreign exchange regulator says that capital inflows could increase further this year as global liquidity has improved due to policy easing by major economies, and interest rates remain low.

In a statement published on its website, the State Administration of Foreign Exchange said China's economic recovery would also contribute to rising capital inflows as pressure of currency depreciation and capital outflows ease.

|

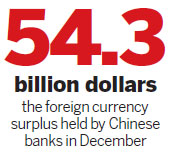

In a separate statement, SAFE said Chinese banks bought $54.3 billion more foreign currency than they sold for clients in December, marking the fourth straight month of net purchases.

Chinese banks were also net buyers of $9.5 billion on the forwards market in December.

Both figures suggested an increased willingness by bank clients to swap foreign currency into local currency at the end of last year.

Throughout 2012, Chinese banks made net foreign exchange purchases of $110.6 billion, 79 percent of which was contributed by net purchases made from September to December, the SAFE figures showed.

SAFE cited various factors for the rising capital inflows, including a stabilizing Chinese economy, progress in tackling Europe's debt crisis and quickening approvals on foreign investment under the qualified foreign institutional investor quotas.

But it said the surge in foreign exchange net purchases by banks cannot be translated as accelerated "hot money" inflows.

"The main reason for extended net purchases was a declining willingness among clients to swap local currency into foreign currency," the administration said.

The government has been concerned that capital inflows could spur inflation and create an asset bubble in the economy, increasing pressure on the national currency to further appreciate, which would harm exports.

"Easy monetary policies within global central banks and improving global growth prospects will continue to drive capital flows to most Southeast Asian economies," said the Australia and New Zealand Banking Group Ltd on Friday in a report.

The United States and Japan said they would continue their near-zero interest rates and inject more liquidity into the markets through asset-purchase programs to shore up economic growth.

On Tuesday, the Bank of Japan announced plans to undertake "unlimited" easing to beat deflation.

Over the past two months the yen has weakened by 9 percent against the dollar, the most among 16 major currencies, according to Bloomberg.

While the yen dropped, expectation of the Chinese yuan's appreciation continues to increase after the currency's strengthening against the dollar in recent months.

"Now investors are betting on the yuan strengthening further. The recent hikes have reflected a change of expectations," said SAFE.

On Friday the central bank set the daily yuan reference rate at its lowest level since Jan 9. The currency reached 6.2124 on Jan 14, the strongest level against the dollar since 1993.