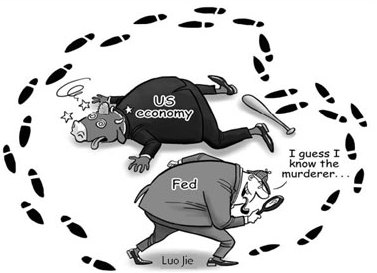

Fed's failures behind US financial crisis

The US Federal Reserve's desperate attempts to keep the US economy from sinking are remarkable for at least two reasons. First, until just a few months ago, the conventional wisdom was that the United States would avoid recession. Now recession looks certain. Second, the Fed's actions do not seem to be effective. Although interest rates have been slashed and the Fed has lavished liquidity on cash-strapped banks, the crisis is deepening.

To a large extent, the US crisis was actually made by the Fed, helped by the wishful thinking of the Bush administration. One main culprit was none other than Alan Greenspan, who left the current Fed chairman, Ben Bernanke, with a terrible situation. But Bernanke was a Fed governor in the Greenspan years, and he, too, failed to diagnose correctly the growing problems with its policies.

Today's financial crisis has its immediate roots in 2001, amid the end of the Internet boom and the shock of the September 11 terrorist attacks.

It was at that point that the Fed turned on the monetary spigots to try to combat an economic slowdown. The Fed pumped money into the US economy and slashed its main interest rate - the Federal Funds rate - from 3.5 percent in August 2001 to a mere 1 percent by mid-2003. The Fed held this rate too low for too long.

Monetary expansion generally makes it easier to borrow, and lowers the costs of doing so, throughout the economy. It also tends to weaken the currency and increase inflation. All of this began to happen in the United States.

What was distinctive this time was that the new borrowing was concentrated in housing. It is generally true that lower interest rates spur home buying, but this time, as is now well known, commercial and investment banks created new financial mechanisms to expand housing credit to borrowers with little creditworthiness.

The Fed declined to regulate these dubious practices. Virtually anyone could borrow to buy a house, with little or even no down payment, and with interest charges pushed years into the future.

As the home-lending boom took hold, it became self-reinforcing. Greater home buying pushed up housing prices, which made banks feel that it was safe to lend money to non-creditworthy borrowers.

After all, if they defaulted on their loans, the banks would repossess the house at a higher value. Or so the theory went. Of course, it works only as long as housing prices rise. Once they peak and begin to decline, lending conditions tighten, and banks find themselves repossessing houses whose value does not cover the value of the debt.

What was stunning was how the Fed, under Greenspan's leadership, stood by as the credit boom gathered steam, barreling toward a subsequent crash. There were a few naysayers, but not many in the financial sector itself. Banks were too busy collecting fees on new loans, and paying their managers outlandish bonuses.

At a crucial moment in 2005, while he was a governor but not yet Fed chairman, Bernanke described the housing boom as reflecting a prudent and well-regulated financial system, not a dangerous bubble. He argued that vast amounts of foreign capital flowed through US banks to the housing sector because international investors appreciated "the depth and sophistication of the country's financial markets (which among other things have allowed households easy access to housing wealth)".

In the course of 2006 and 2007, the financial bubble that is now bringing down once-mighty financial institutions peaked.

Banks' balance sheets were by then filled with vast amounts of risky mortgages, packaged in complicated forms that made the risks hard to evaluate. Banks began to slow their new lending, and defaults on mortgages began to rise. Housing prices peaked as lending slowed, and prices then started to decline.

The housing bubble was bursting by last fall, and banks with large mortgage holdings started reporting huge losses, sometimes big enough to destroy the bank itself, as in the case of Bear Stearns.

With the housing collapse lowering spending, the Fed, in an effort to ward off recession and help banks with fragile balance sheets, has been cutting interest rates since the fall of 2007. But this time, credit expansion is not flowing into housing construction, but rather into commodity speculation and foreign currency.

The Fed's easy money policy is now stoking US inflation rather than a recovery. Oil, food, and gold prices have jumped to historic highs, and the dollar has depreciated to historic lows. Yet the Fed, in its desperation to avoid a US recession, keeps pouring more money into the system, intensifying the inflationary pressures.

Having stoked a boom, now the Fed cannot prevent at least a short-term decline in the US economy, and maybe worse.

The Fed should take care to prevent any breakdown of liquidity while keeping inflation under control and avoiding an unjustified taxpayer-financed bailout of risky bank loans.