Moving toward a world without cash

|

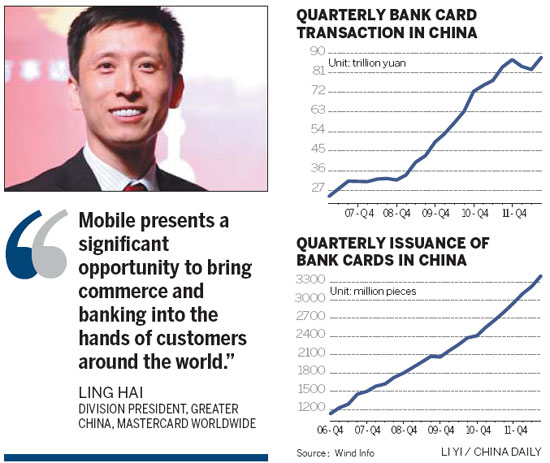

A model decorated with bank cards at an international finance exhibition in Beijing. Statistics from China's central bank showed that around 3.4 billion bank cards had been issued in the country by the end of the third quarter of 2012, up 21.2 year-on-year. Gong Wenbao for China Daily |

Card issuers look to credit and debit as the financial backbone of the future economy

Ling Hai, division president of Greater China for MasterCard Worldwide, has more than 10 bank cards in his wallet - all bearing the MasterCard logo but jointly issued with different Chinese banks.

At one time, when his company launched its No Cash Month campaign in March 2012, he had almost nothing in his wallet apart from his cards.

The campaign, an internal one within MasterCard's Asia-Pacific region, attracted a total of 1,000 employees from 41 teams. They competed with each other to see which team used the least cash or money options such as vouchers in their daily lives in that month.

It turned out Japan had the highest percentage of non-cash transactions, followed by Taiwan and then South Korea.

"Since last year, we've been committing ourselves to a new vision - a world beyond cash. And all our business strategies will center on the theme of reducing the use of cash as much as possible in today's society," said Ling, 43.

The campaign, Ling said, was a part of that commitment.

"Working in a payment technology company, if we cannot take the lead in using non-cash payment channels, how can we expect our customers, our cardholders to use them?" Ling asked.

The result of the campaign also revealed the huge market potential for the company.

Out of all MasterCard employees in the Asia-Pacific, the Middle East and Africa, fewer than 14 percent pay for goods with cash. Globally, nearly 85 percent of purchases by non-MasterCard employees are paid for with cash, according to the company's statistics.

However, employees found out that not using cash in their everyday lives was not all that easy: There are many places where bank cards are not accepted.

"They pass the information on to their colleagues who are in charge of the bank card acceptance business. Why don't those places accept bank cards? How do we encourage them to accept them? Thinking about this drives their colleagues to develop new products and services," said Ling. "Bear in mind no-cash activities can bring lots of benefits."

Innovation in China

According to Ling, the company's core business in China remains cooperating with issuing banks.

"Launching a variety of card products with Chinese banks to cater for the different demands from different customers has been the core business for us over the past years," Ling said. "Meanwhile, we will continue our commitment to innovation and brand marketing."

Visa, MasterCard and China UnionPay are the major players in the electronic payment industry.

As MasterCard is a publicly listed company, Ling said he cannot disclose its growth target this year, but it will lay out a target based on the industry benchmark.

Statistics from China's central bank showed that around 3.4 billion bank cards had been issued by the end of the third quarter of 2012, up 21.2 percent year-on-year. Among them, 3.08 billion were debit cards, up 21.4 percent year-on-year, and 318 million were credit cards, up 18.8 percent year-on-year.

Ling said the company is still confident in China's economy despite the recent slowdown in the nation's economic growth rate.

Cross-border business is a major element of MasterCard's business in China.

"With the development of tourism and the increasing use of electronic payment by Chinese consumers, we believe more bank cards will be issued and our business will continue to grow," said Ling

The company will strengthen cooperation with different banks to tap different cities.

In first-tier cities such as Beijing, Shanghai and Shenzhen, MasterCard has mainly joined hands with large banks to provide products and services to customers.

Along with the booming wealth in second- and third-tier cities, demand from local residents' overseas tourism and buying sprees is also rising.

"To meet the needs of these consumers, we will cooperate with some regional banks as well as small and medium international banks," said Ling.

For instance, MasterCard issued its World Card in cooperation with Shanghai Rural Commercial Bank last October.

Visa Inc, a major competitor of MasterCard, made a similar move. Visa recently partnered with Haikou Bank to issue a single currency credit card in China. It was the first time Visa cooperated with a regional city commercial bank to issue a single currency credit card as it eyed up opportunities in second- and third-tier cities.

"Developing business in second- and third-tier cities is also part of our core business, rather than a new business," said Ling. "Continuing to look for new customers and meet their needs has always been our task."

However, compared with first-tier cities, business volumes from second- and third-tier cities are much smaller.

"But in order to create our vision of a society beyond cash, we will do everything to meet customer demand from second- and third-tier cities," Ling said, adding that innovation determines the future.

"Take mobile payment as an example. We are discussing issues such as whether a physical card will still be in use in the next two years, or whether it will be replaced by mobile payment. We are constantly thinking about the future of the payment industry," Ling said.

For Ling, innovation is like the construction of a highway. The initial stage is very hard. But once the construction is finished, there will be traffic flow. The cars can go wherever the road extends.

However, the highway will not be immutable. As technology advances, the future highway may be developed in any direction, even upwards.

"From the moment of initial development, if we remain immersed in the past and do not grasp opportunities, we will be left behind. We always have a strong sense of crisis. Therefore, we remind our staff to always keep the spirit of innovation in mind," Ling said.

Looking to the future

Ling said mobile payment and e-commerce will always be the focus for MasterCard.

Ling joined the company in January 2010 as division president of Greater China for MasterCard Worldwide. In this capacity, Ling oversees all aspects of MasterCard operations in Greater China, with the objective of building the business and promoting the MasterCard brand. His responsibilities include forging closer business alliances with customers, enhancing MasterCard brand awareness and promoting the usage and acceptance of MasterCard.

Prior to that, Ling was head of partnership business and co-brand marketing with PCCC, a joint venture between HSBC and Bank of Communications.

Before that, Ling worked with Bank of America, where he oversaw product development and customer insights at card services in the United States. He also worked with Booz Allen & Hamilton and A.T. Kearney in both the United States and China and consulted clients in financial services to launch new products and improve business processes.

Ling graduated from the College of Saint Rose in New York and obtained an MBA from the University of Chicago Booth School of Business.

According to Wu Huanyu, a senior manager at MasterCard, Ling always looks to diversify business rather than stick to its core businesses. "He is an advocate for new ideas and innovation but is also quite rational about taking risks," said Wu. "You will be easily impressed by his talent for analysis and decision making."

Under Ling's leadership, MasterCard continued its commitment to mobile payment in China and outlined its vision on how to reach the next billion consumers through mobile innovation and partnerships.

For Ling, the future of reaching the next billion consumers through mobile channels is fuelled by cooperation and innovation in a collective effort by all the players in the "ecosystem", including technology providers, mobile network operators and financial institutions.

"Mobile presents a significant opportunity to bring commerce and banking into the hands of customers around the world. Through an innovative approach to mobile commerce, MasterCard and our partners are striving to unlock the full potential of mobile commerce and bring billions of consumers into a world beyond cash", said Ling.

The company made several moves in the mobile payment sector in 2012. They included the unveiling of Wanda, a joint venture between Telefnica and MasterCard - a new corporate and consumer brand designed to provide mobile payment solutions to more than 87 million Movistar customers in its Latin American markets. Movistar is a major Spanish mobile phone operator owned by Telefnica SA.

These mobile payment services will be linked to a mobile wallet or prepaid account that will allow for money transfers, mobile airtime reload, bill payment and retail purchases, among other services. The mobile wallet and prepaid accounts will be available anytime, anywhere in the world.

huyuanyuan@chinadaily.com.cn

(China Daily 02/07/2013 page15)