HKEx eyeing alliances after 7% profit gain

Updated: 2011-03-03 07:48

By Joy Li(HK Edition)

|

|||||||||

|

The bourse is currently developing its next capacity, which is to become "China's offshore yuan center". Mike Clarke / AFP |

Company posts net income of HK$4.7 billion

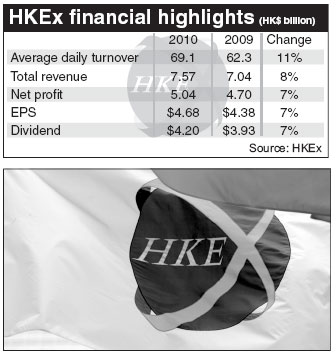

Hong Kong Exchanges & Clearing Ltd (HKEx) said its net profit rose 7 percent in 2010 on robust trading and fundraising activities.

For the 12 months ended Dec 31, net profit rose to HK$5.04 billion or HK$4.68 a share, from HK$4.7 billion or HK$4.38 a share in 2009, the company said Wednesday.

The company raised its final dividend by 7 percent to HK$4.2 per share, maintaining a 90 percent dividend payout ratio.

During the year, revenue rose 8 percent to HK$7.57 billion from HK$7.04 billion a year ago. The bourse mainly generates revenue from trading, clearing and listing fees.

Average daily turnover on the stock exchange rose 11 percent to HK$69.1 billion from HK$62.3 billion. Trading fees and trading tariffs increased 10 percent to HK$2.84 billion from HK$2.59 billion.

Listing fees registered the biggest surge, up 30 percent to HK$945 million from HK$728 million a year ago. The local bourse topped the world in IPOs by raising HK$450 billion in total funds last year.

Looking ahead at 2011, the local bourse operator said it is aiming at strategic alliances that will boost growth as the global economy is expected to continue on its recovery path.

"We may seek strategic alliances with technology providers, industry participants, and our regional and global counterparts to expedite our growth initiatives," HKEx Chairman Ronald Arculli said in a statement. "Any alliance we pursue would need to present strategically compelling benefits consistent with our focus on markets in Greater China."

A number of planned bourse mergers have been in the media spotlight of late. Germany's Deutsche Boerse AG and NYSE Euronext - the parent of the New York Stock Exchange - said in February that they were in talks for a planned merger, which would ultimately create the world's largest financial exchange. Earlier in the same month, the London Stock Exchange Group and Toronto-based TMX Group agreed to join forces. Last October, Singapore Exchange Ltd also put in a bid for the operator of Australia's stock exchange, ASX Ltd.

BMI Fund Management Director Patrick Shum said that "it will be difficult for HKEx to pursue mergers and acquisitions with other bourses as it involves the strategic interests of Hong Kong and the mainland."

"Merger with the mainland bourse will also be difficult as the mainland stock market is still not an open market and there are many structural difference between the two markets," Shum added.

Jeffrey Maddox, a partner at Jones Day, which specializes in initial public offering transactions, thinks that HKEx is unlikely to relax its stringent listing procedure standards, which may be a problem in merger talks.

"HKEx may sign a strategic alliance agreement that allows maybe a 5 to 10 percent stake acquisition of other bourses," Maddox said.

Charles Li, HKEx's chief executive, told media at Wednesday's briefing that the bourse is already well positioned as "China's capital formation center", which bridges mainland issuers to international investors and vice versa.

The bourse is currently developing its next capacity, which is "China's offshore yuan center", according to Li.

To facilitate the issuance of yuan-denominated securities after a slew of yuan bonds that mushroomed in Hong Kong last year, the bourse also unveiled a mechanism that aims to solve the drawback of limited yuan liquidity in the city.

The RMB Equity Trading Support Facility (TSF) is expected to be rolled out in the second half of 2011. The TSF will provide yuan to Hong Kong dollar investors who want to buy yuan-denominated shares but are short of holdings in the mainland currency. The yuan, provided by Hong Kong banks, will be returned to the TSF once the shares are sold and the investors will get their Hong Kong dollars back.

"This is a back-up system for a possible rainy day. But it is also likely that no one uses it because current liquidity is already enough. What we hope from the TSF is to lend more confidence to issuers and investors," said Li, adding that HKEx will inform the market of the timetable for implementation as soon as it is ready.

China Daily

(HK Edition 03/03/2011 page2)