The effects of tapering on HK property and banking sector

Updated: 2013-10-25 06:53

(HK Edition)

|

|||||||||

The US government's QE policy has greatly enhanced global liquidity and led local home prices to skyrocket. Local residential property prices at the end of September, based on the Centa-City Leading Index, have soared 111 percent since the start of the QE policy in 2008.

Since the launch of the three QE policies, more than $100 billion in overseas capital has flowed into the city's financial system, the Hong Kong Monetary Authority (HKMA), the city's de facto central bank, estimates.

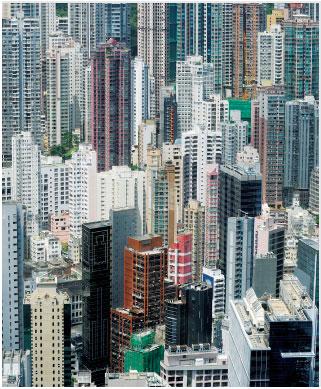

After almost five years of price gains, Hong Kong has become one of the most overvalued property markets in the world. If the US really tapers off QE or raises interest rates, the liquidity conditions of the global financial system will inevitably tighten and that will depress local home prices.

Credit Suisse Managing Director Tao Dong in early October predicted that local residential property prices could slump 15 percent to 20 percent in the second half of 2014 because of liquidity tightening due to US tapering.

HSBC Economist Donna Kwok estimates that local home prices could fall 10 percent which would slash Hong Kong's consumer spending growth by 0.47 percent. The city's economic growth ultimately will be affected.

It is not only the property sector that will be affected by the US tapering gesture. Buoyant home prices shoved the growth of new mortgage loan numbers in the last few years. If the local home market plummets, the negative effects will also be transmitted into the local banking sector.

Household debt (comprising mortgage loans, credit card and personal loans) as a proportion of gross domestic product in Hong Kong rose to 62 percent in midway through this year, which already exceeded the historical high of 60 percent in 2002, says the HKMA.

HKMA Chief Executive Norman Chan said in September that US tapering will lead to gradual capital outflow in Hong Kong that will affect the city's financial and asset markets.

"Overvaluation risks in the property markets and signs of macroeconomic imbalances point to risks of broader economic adjustments and asset price corrections. The US Fed tapering could heighten global financial market volatility, thereby adversely feeding through to fund flows," HKMA said in September.

In addition to the property market, the HKMA adds that the Hong Kong banking sector will face rising business risks in the future.

"The US tapering can provoke fund outflows from Asia, hence squeezing domestic liquidity conditions due to deposit withdrawals, and loan prices could rise significantly ahead of any interest rate hike. The potential impact of a sudden change in local liquidity conditions on loan prices and its possible consequences merit close attention," HKMA says.

"If the interest rates of commercial loans jump, corporations' debt servicing ability would be under test given rising corporate leverage. Moreover, as more Hong Kong banks are lending to mainland companies, rising loan interest rates may also jeopardize the debt-repaying capabilities of these companies. The need for continued stringent management of such exposure cannot be overemphasized," HKMA notes.

(HK Edition 10/25/2013 page5)