Li's CKI-Power Assets merger offer a 'fair deal'

Updated: 2015-11-24 08:15

By Oswalld Chan In Hong Kong(HK Edition)

|

|||||||||

Experts warn all sides could lose out if plan is turned down

As shareholders of Power Asset Holdings Ltd (PAH) prepare to vote on Tuesday on whether to accept or toss out a merger proposal by PAH's parent Cheung Kong Infrastructure Holdings Ltd (CKI) - tycoon Li Ka-shing's infrastructure flagship - financial experts have warned that all parties could lose out if the merger collapses.

CKI proposed in September this year an $11.6-billion stock-for-stock merger of CKI and PAH (formerly Hongkong Electric Holdings Ltd). After the merger, all PAH stocks held by shareholders would be cancelled in exchange for newly issued CKI shares, and PAH would become a subsidiary of CKI.

Earlier this month, proxy adviser Institutional Shareholder Services (ISS) urged PAH shareholders to reject the takeover offer, saying the proposed deal undervalues PAH.

ISS recommended a share-swap ratio range of 1.09 to 1.2 (1 PAH share for 1.09 to 1.2 CKI shares) instead of CKI's proposal of 1.066 shares. Last month, CKI raised the offer of 1.066 of its own shares for every PAH share held - up from 1.04 shares proposed in its original offer. CKI also planned to raise the post-deal cash dividend for all future shareholders by 50 percent to HK$7.5 per share.

Global banking and financial services company Deutsche Bank said it is still uncertain whether the deal can be approved by PAH independent investors although CKI has offered the sweetened proposal to them.

Financial services firm Daiwa Capital Markets believes CKI will not further raise the 1.066 ratio because the investment bank regards it as fair, saying that all parties could lose out if the proposed deal lapsed.

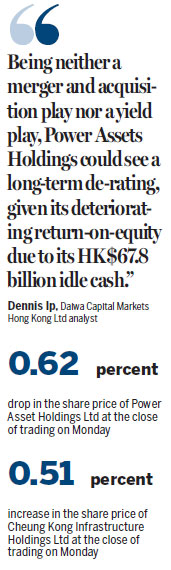

"We do not expect a white knight to emerge to table a better privatization offer for PAH other than the CKI merger offer. Being neither a merger and acquisition (M&A) play nor a yield play, PAH could see a long-term de-rating, given its deteriorating return-on-equity due to its HK$67.8 billion idle cash," said Daiwa Capital Markets Hong Kong Ltd analyst Dennis Ip.

Deutsche Bank also agrees that the merger deal can allow PAH to potentially utilize its cash balance on boarder infrastructure projects instead of being constrained with a power and gas M&A mandate.

"The combined company could have a much robust balance sheet after including off-balance sheet debt. Therefore, the deal is positive for CKI in terms of building up an additional war chest," said Dave Dai, a Hong Kong-based analyst at Credit Suisse.

CKI's valuation would also suffer the negative effect of a CKI-PAH merger failure, but the effect would likely be temporary due to CKI's strong M&A capacity supported by equity financing, Ip said.

The proposed merger would allow an enlarged CKI with a stronger balance sheet and a significant cash balance to capture global opportunities in the infrastructure sector. For PAH shareholders, the proposed merger would enable them to exchange their shares in PAH for new shares in CKI, which has a proven track record of earnings and dividend growth, according to the joint press release by CKI and PAH on Sept 8.

This merger plan marks the latest reorganization of Li's business empire after the high-profile restructuring of his flagship Hutchison Whampoa and Cheung Kong Holdings in January this year.

PAH's share price dropped 0.62 percent to close at HK$72.65 on Monday, while that of CKI surged 0.51 percent to close at HK$69.05.

oswald@chinadailyhk.com

|

Victor Li Tzar-kuoi, (left) chairman of Cheung Kong Infrastructure Holdings Ltd, talks with his father Li Ka-shing at a press conference on Jan 9. Cheung Kong Infrastructure Holdings Ltd is seeking to buy its affiliate Power Assets Holdings Ltd to for further expansion, proposing 1.066 shares of its own shares for every Power Assets share. Roy Liu / China Daily |