H shares of mainland developers soar amid escalating housing bubble fears

Updated: 2016-10-05 07:22

By Lin Wenjie in Hong Kong(HK Edition)

|

|||||||||

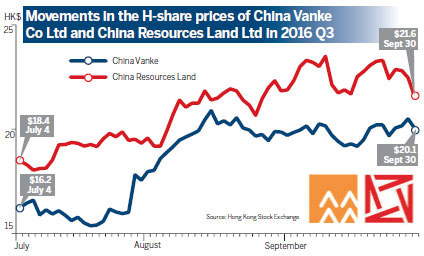

Share prices of Chinese mainland property developers listed in Hong Kong surged in the third quarter, with the strongest jumping more than 30 percent between July and September.

Strong demand has continued to buoy a heated property market, but experts warn that the risks in investing in mainland landlords are increasing as concerns about a real estate bubble gain traction. This has prompted more cities to tighten house purchasing policies.

China Vanke - the country's largest builder - recorded a 32.2-percent hike in its share price in the third quarter, the strongest among all Hong Kong-listed mainland developers. Shares in Country Garden and China Resources Land all jumped more than 20 percent, according to Bloomberg. The benchmark Hang Seng Index climbed 12 percent in the same period.

The bullish stocks show a thriving property market, with average new homes prices in 70 major Chinese cities climbing for the 11th straight month in August, up 9.2 percent from a year earlier. This exceeds the 7.9-percent growth in July, with economically strong areas reporting drastic price rises, and less-developed areas seeing mild price growth.

Housing prices in Shanghai leapt 37.8 percent in August year-on-year, with other first-tier cities, including Shenzhen (37.3 percent) and Beijing (25.8 percent), also recording increases.

Some house hunters in first-tier cities went on a panic buying spree earlier this year, fueled by expectations that prices will continue to surge, enabling them to reap profits. This led to all the first-tier cities tightening purchase policies to curb prices, forcing speculative buyers to second- and third-tier cities, and resulting in more cities having to steady prices.

Local media reported that between last Friday and Sunday, another eight cities had placed restrictions on homes purchases, bringing the total to 10 second- and third-tier cities.

Zhengzhou, capital city of Henan province, announced nine measures on Sept 14 to try and halt increases in land prices. These include a 50-percent premium cap for land auction prices.

In Nanjing, capital city of Jiangsu province, homes buyers who do not have a local residency permit are banned from buying a second property if they already own one in the city's eight major districts. Nanjing residents who already have two homes will not be allowed to buy new homes, the local government announced on Sept 25. Similarly, Hangzhou reintroduced homes purchase restrictions for non-local families who already own one home.

However, experts remain skeptical on how effective these measures will be. JP Morgan said in a recent research note that tightening policies would only have a temporary effect as they are relatively mild. For instance, Hangzhou's measures only apply to non-local families in the city center and do not cover local families or those living outside the center.

The investment bank also said that tightening measures often limit land supply, placing more pressure on house prices to increase, pointing to Shanghai's announcement to suspend land auctions and Zhengzhou's introduction of land price caps.

Hannah Li Wai-han, a strategist at securities broker UOB Kay Hian (Hong Kong), said the risks of investing in mainland developers are increasing, with more cities looking to step up efforts to rein in surging property prices.

"Eyeing the prosperous market, many mainland developers have been aggressive in trying to win land auctions this year. If mainland homes prices stop growing, or even start falling next year, these companies may see their gross profit margins narrowed," she said.

This can be seen in Sunac China, the country's ninth-largest developer. The company announced on Sept 26 it will buy mainland property assets from Legend Holdings for $2.1 billion. The deal is also set to exacerbate Sunac's debt-to-equity ratio, which stood at 221 percent at the end of last year - the highest among its listed peers - according to Thomson Reuters data.

Li said that although China will impose homes purchase restrictions on more cities in the coming months, they are not strong enough to curb surging prices as bank lenders are still relaxed about mortgages and the economic outlook remains uncertain.

"But, if the economy stabilizes next year, the government will then guide banks in tightening lending policies, which will be more effective. So, I see the possibility of prices starting to adjust on the mainland next year," she added.

China's central bank has also taken action by limiting money supply. From Sept 26 to last Friday, the People's Bank of China conducted its largest weekly cash withdrawals since July, amid speculation that it's seeking to ease bubbles in assets such as bonds and property.

The central bank has drained a net 420.1 billion yuan ($63 billion) from the financial system as maturing reverse repurchase agreements exceeded new issuance. The nation's benchmark money-market rate surged to a 14-month high on last Thursday as central bank withdrawals added to pressure created by quarter-end demand from commercial lenders.

cherrylin@chinadailyhk.com

(HK Edition 10/05/2016 page5)