-

News >Bizchina

'Hot money' controllable

2010-06-21 09:02PBOC: No drastic fluctuation in value of the yuan

BEIJING - China will be able to keep inflows of speculative capital under control even if the latest clarifications on its yuan policy trigger any influx of "hot money", a former central bank adviser has said.

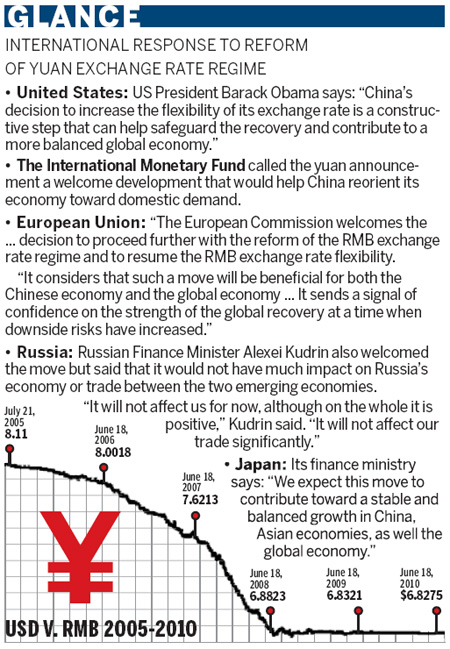

The People's Bank of China, the central bank, said in a statement on Saturday that it will proceed further with the reform of the yuan exchange rate regime to enhance its rate flexibility. The move has been interpreted as the start of allowing the yuan to rise against the US dollar after it remained stable for 23 months.

On Sunday, the central bank said in a statement that it will maintain a stable exchange rate and there will be no drastic fluctuation in the value of the yuan. There will be no one-off adjustment in the value of the yuan and the fluctuation of its value must be "controllable" to prevent market forces from causing excessive swings, it said.

"The basis for large-scale appreciation of the yuan exchange rate does not exist," it said.

The statement emphasized the yuan be pegged to a basket of currencies, adding that the US dollar should not be the only gauge for judging the renminbi exchange rate level.

Keeping the rate at a "reasonable, balanced level" will contribute to economic stability and help restructure the Chinese economy with greater emphasis on services and consumption, it said.

"The stance is clear: The yuan will enter a track of gradual appreciation," said Zhang Xiaojing, an economist with the Chinese Academy of Social Sciences.

"Although depreciation cannot be ruled out given the falling euro, the yuan could rise in the short term."

Still, the approach has triggered concern that more speculative capital, or "hot money", will flow into the country to gain from any continual appreciation of the yuan.

"The possibility is there," said Yu Yongding, a former member of the central bank's monetary policy committee.

"But we should not panic and stop allowing the yuan to get more flexible simply because of that; we can keep it under control by enhancing cross-border capital control," Yu, who is also head of the China Society of World Economics, told China Daily.

"More flexibility does not mean one-way appreciation," he said. "It would be a two-way movement, which would help thwart currency speculation."

The country's decision to shift to a basket of currencies as a reference for the yuan's value will also give policymakers more room to maneuver in their effort to control cross-border capital flows, he said.

The gradualist way of currency appreciation, while causing more inflows of speculative capital, will help control such adverse capital movement, analysts said.

If the annual appreciation of the currency can be kept below 3 percent, it will make it hard for speculators to profit, since they will have to pay dual-way transaction costs that will be close to what they can gain from a rising yuan, said Zhou Shijian, senior economist at the China-US relations research center of Tsinghua University. "If the yuan rises, it must be narrow-floating."

A hasty, swift appreciation of the yuan will make it difficult to control an influx of "hot money" and endanger the Chinese economy, Zhou said, citing widespread trade sector bankruptcies and job losses in the country from October 2007 to July 2008, when the yuan appreciated by 11 percent against the dollar, compared with about 8 percent in the previous two and a half years.

"By claiming that there would be no one-off revaluation this time, the authorities have obviously learnt from that experience," Zhou said.

The yuan has risen by 21 percent against the greenback since 2005. Economists said that if the currency rises gradually, it will benefit the Chinese economy, although it could also bring about uncertainties as the lingering European debt crisis will dampen Chinese exports to Europe, China's largest trade partner.

A rising yuan will also make Chinese imports cheaper, they said. China is now a major importer of such commodities as oil and iron ore.Similarly, the country's economic restructuring could accelerate toward a services- and consumption-driven economy.

In the short term, efforts to control inflation will be beneficial as well, said Nouriel Roubini, an economist and chairman of economics consultancy Roubini Global Economics.

"Given the context that (China's) inflation is rising, a gradual process of appreciation of the yuan against the dollar is useful not only for the US, but more so for China, because domestic consumption would be cheaper, and it would allow credit policies to cool off."

Wang Bo in Beijing and Ding Qingfen in Washington contributed to this story.

CHINA DAILY