Societe Generale Q3 profit slumps 31% on Greek debt

|

The headquarters of Societe Generale SA in Paris. The French lender took a 333-million-euro ($458.3 million) pretax write-down on its Greek sovereign debt holdings. Chris Ratcliffe / Bloomberg |

Shareholders see no dividend as lender reels from write-down loss

PARIS - Societe Generale SA, France's second-largest bank, said third-quarter profit fell 31 percent, hurt by a write-down on Greek sovereign debt and lower trading revenue. The company won't pay a dividend for 2011.

Net income dropped to 622 million euros ($855 million) from 896 million euros a year earlier, the Paris-based lender said in a statement on Tuesday. The bank took a 333-million-euro pretax write-down on its Greek sovereign debt holdings.

The results "aren't remarkable", said Pierre Flabbee, a Paris-based analyst at Kepler Capital Markets who has a "hold" rating on the stock. "They're giving no dividend. That's never good news."

Societe Generale, which said in August it may miss a 6-billion-euro profit target for 2012, follows larger rival BNP Paribas SA in increasing its write-down of Greek debt to 60 percent. The two banks are trimming assets to comply with new capital rules after their stock plunged and US money-market funds became reluctant to lend to them in dollars.

BNP Paribas said last week that third-quarter profit fell 72 percent because of a 2.26 billion-euro write-down on Greek debt and losses from selling European government bonds.

Asset reductions

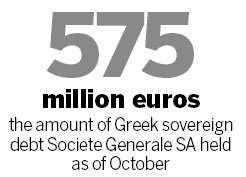

While Societe Generale's Greek sovereign holdings are less than those of BNP Paribas, French banks as a whole held more of Greece's public and private debt than lenders from any other country at the end of June, according to Bank for International Settlements data.

The two companies announced in September steps leading to trim a combined 300 billion euros of assets by 2013. Societe Generale said on Tuesday that at the end of September it reduced the liquidity needs of its corporate- and investment-banking unit by 40 billion euros.

Societe Generale's capital-markets revenue fell 51 percent to 631 million euros in the quarter. The company follows BNP Paribas, Deutsche Bank AG and Barclays PLC in recording lower investment-banking revenue as concern that Greece may default crimps income from trading and underwriting stocks and bonds in Europe.

Provisions rise

Earnings at Societe Generale's corporate- and investment- banking business dropped 84 percent to 77 million euros in the quarter as results at its fixed income, currencies and commodities business was "sharply" lower, the lender said.

Societe Generale's total provisions rose to 1.19 billion euros in the third quarter from 918 million euros a year earlier, hurt by the Greek sovereign-debt write-down, the bank said.

After Greece, the eurozone sovereign debt crisis is threatening to spread to larger eurozone countries. European finance ministers returned to Brussels on Monday on a mission to convince global leaders that they can shield countries such as Italy and Spain.

Societe Generale held about 1.6 billion euros in Italian debt as of October, while the amount of Greek sovereign bonds on its banking book fell to 575 million euros, the company said.

Capital needs

French banks need to reinforce their capital by 8.8 billion euros, according to European Banking Authority (EBA) tests released last month. Societe Generale will have to bolster its finances by 3.3 billion euros, while BNP Paribas needs 2.1 billion euros, according to the EBA figures. Both companies have said they won't tap shareholders for new capital.

Societe Generale's decision to not pay a dividend will help reduce its additional EBA capital requirements to 2.1 billion euros, the bank said on Tuesday.

French Prime Minister Francois Fillon said on Nov 2 that he had ordered the country's banks to present detailed plans of how they intend to meet new capital targets by Dec 15. Finance Minister Francois Baroin said on Nov 6 that France's four largest banks won't need state aid as the capital goal is "accessible" through retained earnings and asset reductions.

Capital surcharge

Societe Generale, BNP Paribas, Groupe Credit Agricole and Groupe BPCE, France's four largest banks, face EU requirements to hold 9 percent in core reserves by mid-2012, after sovereign debt write-downs, under plans adopted last month by EU regulators.

They are also among 29 lenders that may have to meet additional capital requirements for so-called systemically important financial institutions under plans approved last week by the G20 nations.

Bloomberg News