Carbon permit drop reflects falling EU industrial output

|

Falling prices together with oversupply of carbon permits in Europe may reduce the incentive for companies and utilities to turn away from cheaper, more-polluting forms of energy. Mike Wilkinson / Bloomberg |

LONDON - The slide in European Union carbon permits to their lowest level since 2009 is underlining how the region's sovereign-debt crisis is hurting industrial production.

The December 2011 contract sank 7.3 percent on Wednesday, the biggest price decline in five months, extending this year's loss to 41 percent. European manufacturing shrank this month, London-based Markit Economics said on Wednesday.

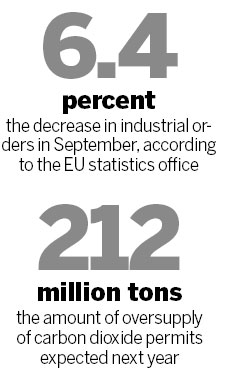

An EU statistics office report showed industrial orders fell 6.4 percent in September, the biggest drop in almost three years, signaling less need for fuels and, in turn, emission permits.

"The EU economic situation is the huge dog that's wagging the tail, the emissions trading system," said Robert Stavins, director of Harvard University's Environmental Economics Program and one of the architects of a US program started in the 1980s that used cap-and-trade to control acid rain. "Current demand and expectations of future demand are low."

Lower economic output curbs demand from about 11,000 factories and power stations in the bloc that require allowances and credits when burning fossil fuels.

Falling prices together with oversupply of carbon permits in Europe may reduce the incentive for companies and utilities to turn away from cheaper, more-polluting forms of energy, such as coal.

December 2011 carbon closed at 8.44 euros ($11.28) a ton on the ICE Futures Europe exchange in London, a record low for that contract. In February 2009, the benchmark December contract for that year fell to 8.05 euros a ton.

Cap-and-trade rules

The EU program, the world's biggest greenhouse gas market, will be oversupplied by 212 million tons of carbon dioxide next year, or 9.1 percent of forecast emissions, according to a Bloomberg New Energy Finance model.

The rules governing the allocation of permits in the cap-and-trade system were determined before the 2008 financial crisis hurt the region's economic production.

Carbon allowances may drop as low as 3 euros because of weaker demand and "staggering" supply, Per Lekander, an analyst in Paris for UBS AG, forecast on Nov 17. Barclays Capital said on Monday that permits may drop below 6 euros, assuming there is another recession.

United Nations credits, which can be used for compliance in the EU, plunged 7.8 percent on Wednesday to a record low of 5.90 euros for the December 2011 contract.

In 2007, during the first phase of the EU emissions market, when surplus allowances could not be transferred into subsequent periods, the benchmark contract fell as low as 1 euro cent. The second phase began in 2008 and surplus permits can be held over for use in the third phase, which will last from 2013 through 2020.

Buying in advance

Power generators will be required to buy all of the carbon permits they need for compliance from 2013, rather than getting most of them for free from national governments.

While utilities typically sell a large portion of their generation capacity up to three years in advance and therefore need to buy fuel and carbon contracts as a hedge, demand for allowances out to 2014 is not currently strong enough to keep prices rising, according to Richard Chatterton, a London-based analyst at New Energy Finance.

Dutch energy company Eneco Holding NV and two other European utilities this week urged the bloc's regulators to propose an "ambitious" climate and energy package for 2030 to help buttress prices.

Predictability

"The power industry requires long-term predictability of the EU's commitment on the decarbonization of the energy system, in order to make the necessary investments in technological innovations and the low-carbon energy supply chain to bring down the costs," Eneco, Denmark's Dong Energy A/S and the UK's second-largest electricity producer SSE PLC said in a joint statement on Tuesday.

Stricter rules on energy efficiency proposed in June may undermine the carbon market without much tougher 2030 greenhouse-gas limits, Mark Meyrick, Rotterdam-based head of carbon at Eneco Energy Trade BV, said on Wednesday.

"I cannot imagine that it would be beneficial to see a separate set of EU rules on energy efficiency or renewables," he said. "Far better is a high emissions reduction requirement, and thus carbon price, in order to incentivize investment in energy efficiency and renewable sources."

Bloomberg News