Fears over US consumer debt

|

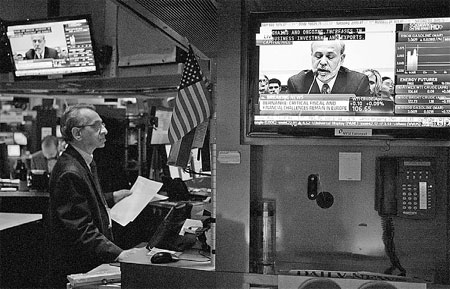

A monitor showing US Federal Reserve Chairman Ben S. Bernanke giving his semi-annual monetary policy report to Congress while traders work at the New York Stock Exchange in New York. Bernanke said that maintaining monetary stimulus is warranted even as the unemployment rate falls and rising oil prices may cause inflation to rise temporarily. [Scott Eells / Bloomberg] |

Concern over some banks' proposals to pay dividends and buy back shares

The US Federal Reserve is pushing back against some banks' proposals to pay dividends and repurchase shares after concluding that the lenders are underestimating the potential for losses on consumer debt in a severe economic slump, according to two people with knowledge of the situation.

Executives and Fed examiners have been wrangling in recent weeks over the central bank's stress-test process as the March 15 deadline for results approaches.

The Fed hasn't yet given banks a ruling on their proposed payouts or told firms how much higher its estimates are for losses on mortgage loans and credit cards, the people said. Examiners are still fine-tuning calculations, which may change.

"If the Fed fights back and disagrees and is more aggressive in their stance on cards and mortgages, it would mean banks wouldn't be able to pay out as much," missing investors' expectations, said Glenn Schorr, a senior bank analyst for Nomura Securities in New York. Investors expect banks will pay out 50 percent to 60 percent of earnings this year, he said.

The exams may bolster confidence in the nation's largest banks by demonstrating they can handle a deeper downturn or a "market shock" after a year in which financial markets were battered by prolonged economic weakness and the European debt crisis. Thirty-one lenders are undergoing tests and submitting capital plans that the Fed must approve before they can boost payouts and share buybacks.

The Fed's 25 economic variables in the tests include a 13 percent jobless rate and a 20 percent slump in home prices.

During the tests, the Fed has generally predicted banks would suffer greater losses than what firms estimated in capital plans that they submitted in January, said the people, who asked not to be identified because the results aren't public. The difference was generally low - about 5 percent to 10 percent - when the Fed estimated losses from trading, exposure to Europe's sovereign debt crisis, commercial lending and other non-consumer risks, according to one person.

The divergence was greater when estimating losses linked to consumers - especially on mortgage-linked holdings and credit card loans - where the Fed's projections have in some cases been almost double those of the banks, according to the person.

Barbara Hagenbaugh, a Fed spokeswoman, declined to comment.

"They're very worried about the consumer," said Paul Miller, a former examiner for the Federal Reserve Bank of Philadelphia and analyst for FBR Capital Markets in Arlington, Virginia. Consumers have been stretched thin in recent years and are vulnerable to economic pressures, he said. "If we go into another recession, a lot of risk officers feel this is where the damage will be done."

Banks may be forced to raise capital if the Fed determines they lack adequate reserves and can't earn enough to maintain a minimum capital ratio of 5 percent under the Fed's most adverse economic scenario, according to the two people. The Fed is gauging how much capital banks have on hand to withstand a severe recession and measuring firms' abilities to generate earnings to cover future losses, the people said.

"If you don't make a lot of money, we don't think the Fed's going to give you a blessing to return capital to shareholders," Miller said.

Bank of America Corp's performance in the stress test may be hurt most among the four biggest United States lenders if the Fed's estimates for consumer-loan losses is greater than the financial industry's, Schorr and Miller said. The bank, ranked second by assets in the US behind JPMorgan Chase & Co, didn't ask to raise its dividend or buy back stock in its capital request to the Fed, Chief Executive Officer Brian T. Moynihan told analysts in a Jan 19 conference call.

"We didn't ask for anything in the stress test," Moynihan said at a March 8 conference in New York. "The key is to just get ourselves in the right position as we exit this year." To help shore up the company's capital base, Moynihan sold $33 billion in assets and announced 30,000 job cuts last year.

Larry Di Rita, a spokesman for the company, based in Charlotte, North Carolina, declined to comment.

"Bank of America would get the double-whammy of having a large credit-card business but also the largest mortgage exposure and also have not yet fully built back up their capital and reserves," Schorr said. "The only saving grace is they're not asking for a dividend or buyback."

Any bank that fails a stress test may be barred from returning capital to shareholders and forced to revise its capital plan, which could include "actions to improve its capital adequacy", the Fed said in a Nov 22 description of the stress exams.

Regions Financial Corp and SunTrust Banks Inc are among regional lenders that may have difficulty passing the stress tests, said Miller and Brian Foran, an analyst at Nomura. Both have mortgage portfolios concentrated in Florida, where home prices have fallen 49 percent since the start of the crisis.

"The reason those guys have the most exposure is because of where they are," Foran said. "Florida is going to have a lot of underwater real estate."

Bloomberg