Weibo makes debut on Nasdaq

Twitter-like service provider aims to raise $328 million in US market

Weibo Corp, Twitter Inc's counterpart in China, made its debut on the Nasdaq in the United States on Thursday, becoming the first publicly traded Chinese social media company.

The micro-blogging service, owned by Sina Corp and Alibaba Group Holding Ltd, priced its initial public offering at $17 per share, which was at the bottom of its planned range between $17 and $19. It opened unchanged at the issue price.

The Beijing-based company, which began trading publicly under the ticker WB, said it hopes to sell 16.8 million Class-A American depositary shares, less than its original plan of selling 20 million shares.

The IPO would allow Weibo to raise up to $328.44 million in capital. Twitter Inc raised $1.8 billion from its IPO in November 2013.

Charles Chao, chief executive officer and chairman of the board of Sina Corp, said the setting of any IPO price is based on demand and supply in the stock market.

"Because of the recent downturn of the IPO market in the US, we are happy that we can still set Weibo's IPO price at the bottom of our initial targeted range," Chao said at an online media briefing to a group of reporters on Thursday night Beijing time, ahead of the IPO.

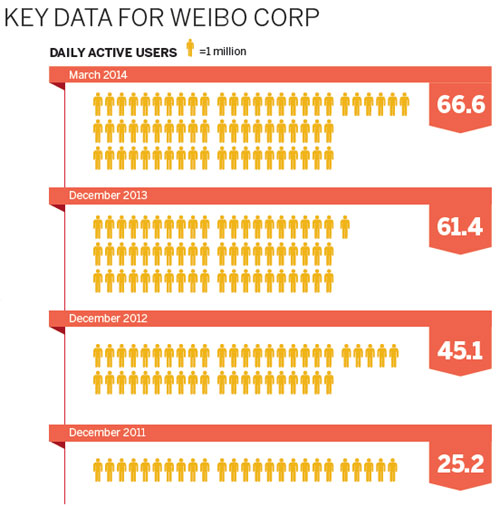

Weibo, which reported a monthly active user base of 144 million as of March this year, first filed for its IPO on March 14, joining seven other Chinese Internet companies seeking capital in the US. That doesn't include China's e-commerce conglomerate Alibaba, which is approaching a highly anticipated IPO in the US.

Alibaba agreed a year ago to buy a 19 percent stake in Weibo for $586 million and plans to exercise an option to raise that stake to 32 percent.

Weibo was established in 2009. The company has only been profitable in the fourth quarter of 2013. The company reported a net loss of $47.4 million in the first quarter of this year. This is more than twice the $19.2 million loss it posted in the same quarter last year.

Revenues of $67.5 million in the first quarter of this year were more than double the previous year's, but they fell about 5.5 percent from the previous quarter. The company attributed the shrinking revenues to the seasonal effects of the Chinese Lunar New Year, saying the performance was in line with its expectations.

Analysts worried that Wall Street investors may not be as enthusiastic about Weibo as they were about Twitter's IPO five months ago.

Tian Hou, chief analyst with T. H. Capital LLC, an independent research and investment advisory firm, said it was no surprise Weibo failed to reach its initial target of raising $500 million as it suggested it would in its Securities and Exchange Commission filings.

"The primary reason is the downturn of the overall stock market in the US. Many US-listed Internet companies, such as China's e-commerce company Vipshop Holdings Ltd and China's search giant Baidu Inc, saw their share prices drop in recent weeks," Tian said.

Wang Xiaofeng, an analyst with US-based consultancy Forrester Research Inc, said Weibo missed the best time to go public because of the changing dynamic in the Internet industry in China, which has seen more powerful competitors emerging over the past year.

"We are all aware that it has been 'beaten up' by Tencent Holdings Ltd's WeChat, which is the most popular messaging app in China's mobile Internet sector," she said.

According to Wang, the two platforms differ in their potential for public broadcasting and promotional use, to which Weibo is currently better suited.

"The biggest challenge for Sina Weibo therefore is finding a way to increase the targeting ability of its current advertising and provide more effective marketing offerings to marketers before they find alternative social platforms on which to market or before user activity drops further," she said.

mengjing@chinadaily.com.cn

|

Feng Xiuxia / China Daily |