It's game over for the American consumer. Inflation-adjusted personal consumption expenditures are on track for rare back-to-back quarterly declines in the second half of 2008 at a 3.5 percent average annual rate. There are only four other instances since 1950 when real consumer demand has fallen for two quarters in a row. This is the first occasion when declines in both quarters will have exceeded 3 percent. The current consumption plunge is without precedent in the modern era.

The good news is that lines should be short for today's "first shopping day" of the holiday season. The bad news is more daunting: rising unemployment, weakening incomes, falling home values, a declining stock market, record household debt and a horrific credit crunch.

But there is a deeper, potentially positive, meaning to all this: Consumers are now abandoning the asset-dependent spending and saving strategies they embraced during the bubbles of the past dozen years and moving back to more prudent income-based lifestyles.

This is a painful but necessary adjustment. Since the mid-1990s, vigorous growth in American consumption has consistently outstripped subpar gains in household income. This led to a steady decline in personal saving. As a share of disposable income, the personal saving rate fell from 5.7 percent in early 1995 to nearly zero from 2005 to 2007.

In the days of frothy asset markets, American consumers had no compunction about squandering their savings and spending beyond their incomes. Appreciation of assets - equity portfolios and, especially, homes - was widely thought to be more than sufficient to make up the difference. But with most asset bubbles bursting, the United States' 77 million baby boomers are suddenly facing a savings-short retirement.

Worse, millions of homeowners used their residences as collateral to take out home equity loans. According to Federal Reserve calculations, net equity extractions from US homes rose from about 3 percent of disposable personal income in 2000 to nearly 9 percent in 2006. This newfound source of purchasing power was a key prop to the American consumption binge.

As a result, household debt hit a record 133 percent of disposable personal income by the end of 2007 - an enormous leap from average debt loads of 90 percent just a decade earlier.

In an era of open-ended house price appreciation and extremely cheap credit, few doubted the wisdom of borrowing against one's home. But in today's climate of falling home prices, frozen credit markets, mounting layoffs and weakening incomes, that approach has backfired.

A decade of excess consumption pushed consumer spending in the US up to 72 percent of gross domestic product in 2007, a record for any large economy in the modern history of the world. With such a huge portion of the economy now shrinking, a deep and protracted recession can hardly be ruled out. Consumption growth, which averaged close to 4 percent annually over the past 14 years, could slow into the 1 percent to 2 percent range for the next three to five years.

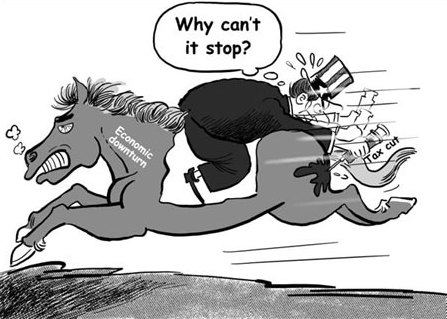

The US needs a very different set of policies to cope with its post-bubble economy. It would be a serious mistake to enact tax cuts aimed at increasing already excessive consumption. Americans need to save. They don't need another flat-screen TV.

The Obama administration needs to encourage the sort of saving that will put consumers on sounder financial footing and free up resources that could be directed at long overdue investments in transportation infrastructure, alternative energy, education, worker training and the like.

This strategy would not only create jobs but would also cut the US' dependence on foreign saving and imports. That would help reduce the current account deficit and the heavy foreign borrowing such an imbalance entails.

We don't need to reinvent the wheel to come up with effective saving policies. The money has to come out of Americans' paychecks. This can be either incentive driven or mandatory, like increased social security contributions. As long as the economy stays in recession, any tax increases associated with mandatory saving initiatives should be off the table.

Fiscal policy must also be aimed at providing income support for newly unemployed middle-class workers - particularly expanded unemployment insurance and retraining programs. A critical distinction must be made between providing assistance for the innocent victims of recession and misplaced policies aimed at perpetuating an unsustainable consumption binge.

Crises are the ultimate in painful learning experiences. The US cannot afford to squander this opportunity. Runaway consumption must now give way to a renewal of saving and investment. That's the best hope for economic recovery and for the US' longer-term economic prosperity.

The author is the chairman of Morgan Stanley Asia The New York Times Syndicate

(China Daily 12/02/2008 page9)

|

|

|

|

|

|

|

|