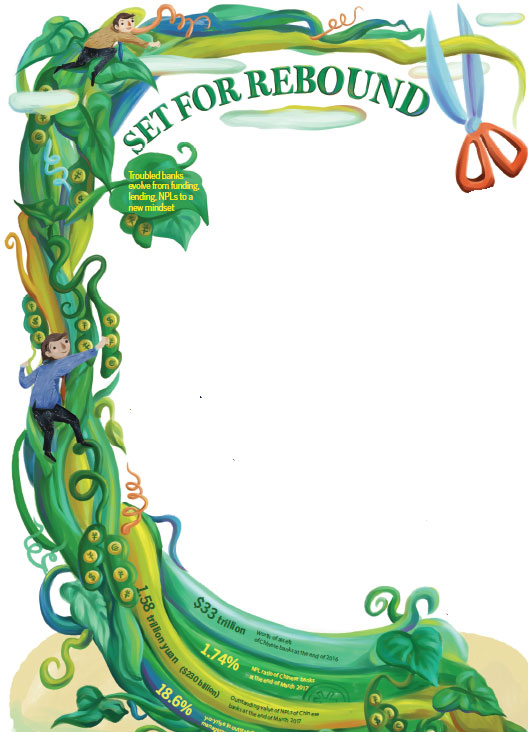

Troubled banks evolve from funding, lending, NPLs to a new mindset

Chinese banks seem to be facing a "best of times, worst of times" moment.

Not so long ago (by the end of last year to be precise), Chinese banks' assets reached $33 trillion, surpassing the eurozone as the world's largest banking system.

That was attributed to ample liquidity, new technology, growing demand for sophisticated financial services from domestic companies and an upwardly mobile middle class - factors that enabled Chinese banks to aggressively seek business innovation and beef up their balance sheets.

But now, prospects for Chinese banks appear to be dimming. Banks are seen becoming increasingly vulnerable to the current macroeconomic conditions.

With intensified regulation as well as disruptive innovations led by rivals in the financial technology, or fintech, space are seen unsettling traditional banks.

Analysts said banks urgently need to respond to the multiple challenges by transforming their business models and improving risk management capability.

"The new business has brought huge opportunities for the banks. But many of them are 'running naked' as their risk management capability failed to match their business growth," said John Qu, a senior partner at global consulting firm McKinsey & Company.

The massive expansion of the banks' balance sheets over the past decade has been underpinned by the excess credit growth since 2008. The Chinese government had sought to stimulate the economy with a more proactive monetary stance to cushion the impact of the global financial crisis.

Now, as China's economic growth slows, banks are beginning to feel the pain of swelling non-performing loans or NPLS and weakened asset quality.

The structural reforms, with an emphasis on disposing of the loss-making State-owned "zombie" companies and reducing corporate debt leverage, have made it even more challenging for banks to deal with rising bad loans and to cope with credit defaults.

Banks' profitability has also been under pressure due to the shrinking net interest margin resulting from the liberalization of interest rates and a string of rate cuts by the central bank in 2014 and 2015.

In analysts' view, what's more worrisome is the explosive growth of the shadow banking sector and the off-balance-sheet wealth management products sold by the banks, raising concerns about illegal practices and leveraged speculation as many of them thrived in a regulatory void.

The recent scandal involving China Minsheng Bank in the sale of fake wealth management products worth 1.65 billion yuan ($239 million) to its clients has exposed the bank's weak internal controls.

The runaway growth of banks' off-balance-sheet assets has intensified regulation as the country's top leadership made prevention of financial risks and reduction of leverage key priorities.

Cliff Sheng, partner and head of financial services forOliver Wyman Greater China, said that the regulatory tightening will prompt the banks to slow down their aggressive expansion and reflect on their existing business models.

"The banks have for long enjoyed the advantage of low-cost funding from corporate and private deposits on the liability side. But their capabilities on the asset side need to be strengthened on top of traditional corporate lending such as the ability in consumer finance and the ability to efficiently dispose of non-performing loans," Sheng said.

He further said the banks' traditional funding and lending model is running out of steam and the banks will face persistent profitability and cost control pressure in the coming years.

For the first time in six years, China's four largest banks cut the headcount by more than 17,000 employees last year, according to their earnings reports.

The headcount cut was seen as a move to strengthen cost discipline and raise operational efficiency, which have been relatively minor concerns until recently.

With fintech companies eating into their business, traditional banks are now seeking partnerships with technology firms. For instance, China Construction Bank, the country's second largest lender by assets, recently formed a strategic partnership with Ant Financial, the financial arm of the e-commerce giant Alibaba Group.

"The partnership was a meaningful attempt. But the competition between the traditional banks and the fintech companies will be a long-standing phenomenon as the ambitious technology companies such as Alibaba and Tencent are aspiring to be key players in financial services," Sheng said.

Looking ahead, analysts said that banks need to adopt a balanced and prudent growth model and should be prepared for external shocks such as the impact of the interest rate hikes by the US Federal Reserve.

Consulting firm McKinsey & Company warned in its report that the Fed's interest hikes will likely trigger a rate hike competition among countries, which will squeeze banks' liquidity and undermine their capital position.

"It is highly likely that China will enter a rate-increase cycle," Eric Kuo, an analyst at McKinsey and one of the authors of the report, said.

"The interest rate hike will mean greater liquidity pressure on the banks. It could also lead to declining profitability and rising corporate credit defaults," he said.

Shen Juan, a banking analyst at Huatai Securities Co, said the first-quarter rebound in China's economic growth will create room for banks to improve asset quality and profitability.

lixiang@chinadaily.com.cn