|

OPINION> Commentary

|

|

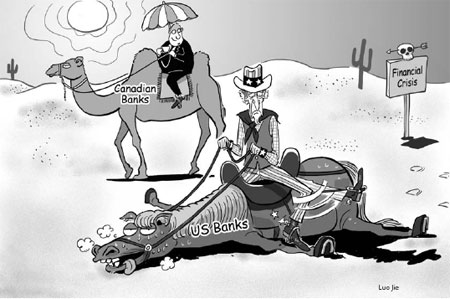

US banks should copy neighbor's example

By Theresa Tedesco (China Daily)

Updated: 2009-03-04 07:47 Has the world turned upside down? America, the capital of capitalism, is pondering nationalizing a handful of banks. Meanwhile, Canada, whose banking system had long been notorious for its stodgy practices and government coddling, is now being celebrated for those very qualities. The Canadian banking system, which proved resilient in the global economic crisis, is finally getting its day in the sun. A recent World Economic Forum report ranked it the soundest in the world, mostly as the result of its conservative practices. (The United States ranked 40th). President Obama has joined the adoring throng. He recently said that Canada has "shown itself to be a pretty good manager of the financial system in the economy in ways that we haven't always been here in the United States." Paul Volcker, former chief of the United States Federal Reserve, commented that what he's arguing for "looks more like the Canadian system than the American system". Most people don't know that the vision behind Canada's banking system, made up of a few large, national banks with branches from coast to coast, actually had its beginnings in the United States. Canada's system is the product of a banking framework inspired by Alexander Hamilton, the first American secretary of the Treasury. Hamilton envisioned the First Bank of the United States, chartered in 1791, as a central bank modeled on the Bank of England. Canadians found inspiration in Hamilton's model, but not all Americans did. In the 1830s, President Andrew Jackson opposed extending the charter of the Second Bank of the United States, perceiving it as monopolistic. Money-lending functions were then assumed by local and state-chartered banks, eventually giving rise to the free-market, decentralized system that America has today. Today, Canada's system remains truer to Hamilton's ideal. The five major chartered banks, the few regional banks and a handful of large insurance companies are all regulated by the federal government. Canadian banks are relatively constrained in the amounts they can lend. They are required to have a bigger cushion to absorb losses than American banks. In addition, Canadian government regulations protect domestic banks by limiting foreign competition. They also keep banks broadly owned by public shareholders. Since Canada's financial services sector was deregulated in 1987, permitting the banks to buy brokerage houses, they have enjoyed vast earnings power because of their diverse businesses and operations. And in contrast to the recent shotgun marriages at bargain prices between ailing Wall Street brokerages and American banks, Canadian banks paid top dollar decades ago for profitable, blue-chip investment firms. Canadian banks are known to be risk-averse, and this has served them well. While their American counterparts were loading up their books with risky mortgages, Canadian banks maintained their lending requirements, largely avoiding subprime mortgages. The buttoned-down banks in Canada also tended to keep these types of securities on their books, rather than packaging them and selling them to investors. This meant that the exposures they did have to weak mortgages were more visible to the marketplace. The big five Canadian banks - Royal Bank of Canada, Toronto-Dominion Bank, Bank of Nova Scotia, Canadian Imperial Bank of Commerce and Bank of Montreal - survived the recent turmoil relatively unscathed. Their balance sheets remain intact and their capital ratios are comfortably above requirements. Yes, Prime Minister Stephen Harper's government may buy as much as 125 billion Canadian dollars (about $100 billion) worth of mortgages, increasing banks' capacity to lend. But this is small change compared with the scale of Washington's bailout. Few would have predicted that Canadian banks, long derided as among the least autonomous because of stringent government oversight, would emerge from the global mayhem as some of the more independent international players. Since Mr Obama seems to admire the Canadian banking system, his administration might want to take a page out of its playbook.

This would entail building a national banking system based on a small number of large, broadly held, centrally and rigorously regulated firms. Imitating the Canadian model would require sweeping consolidation of American banks. This would be a very good thing. Washington had difficulty figuring out the magnitude of the financial crisis because there are so many thousands of banks that it was impossible for regulators to get into all of them. Washington is already on the path to achieving consolidation. Eventually, some of the larger banks into which the government is injecting taxpayer money will probably be deemed beyond help, and will either be allowed to die or be partnered with other banks. The market will take its cues from this stress-testing, and make its own bets on which banks will survive. It's hard to predict how many will have survived when the dust settles, but the new landscape might consist of only 50 or 60 banking institutions. More radically, Washington could take over the licensing of banks from the states, or, at the very least, consider more stringent regulation of global and super-regional banks. After all, the Canadian system is considered successful not only because it has fewer banks to regulate, but because regulation is based on the tenets of safety and soundness. There is no time to waste. Reconfiguring the American banking structure to look more like the Canadian model would help restore much-needed confidence in a beleaguered financial system. Why not emulate the best in the world, which happens to be right next door? At the very least, Hamilton would have approved. The author is the chief business correspondent for The National Post, The New York Times Syndicate (China Daily 03/04/2009 page9) |