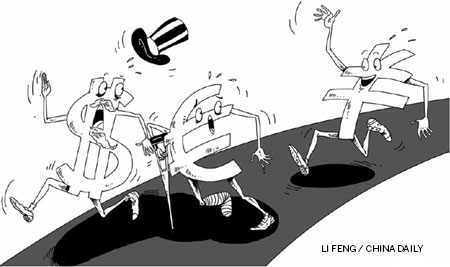

Yuan for the international road

Financial crises in the United States and Europe mean the world needs a new, more stable global reserve currency, and rapidly rising trade in renminbi. In the foreign exchange market, for example, RBS Group figures show that the volume of renminbi trade is now about $5-6 billion a day, double of what it was a year ago.

A number of factors suggest that China wants to internationalize its currency by 2015.

First, the International Monetary Fund is reviewing its special drawing rights basket, which uses four key international currencies to supplement member countries' official reserves and bolster liquidity. The deadline for completing that review is 2015.

Based on where the G7 countries are today, we believe there's a very strong chance that China can get the CNY, the onshore version of the renminbi, into that basket, which will be a real boost to the currency on the world stage.

Also, the Shanghai municipal government has set a goal of making the city the global pricing center for both onshore and offshore renminbi financial products by 2015 and a global financial center by 2020. These goals clearly set the blueprint for the internationalization of the renminbi.

Then there are China's efforts alongside that of the United Kingdom to promote London as a CNY center, which would operate in partnership with China's Hong Kong Special Administration Region. Achieving this would make London the first CNY hub outside China and be a big step toward the internationalization of the renminbi.

As part of this, the People's Bank of China (the central bank) could sign a currency swap line with the Bank of England within a year, or two at the most, enabling both banks to exchange a fixed amount of each other's currencies to stabilize their own and improve liquidity. In time, London could even set up its own clearing bank for the CNY.

There are plans to set up another CNY center in Singapore, but the Chinese authorities see this more as a regional hub. They want Hong Kong to partner with London so that they have first-mover advantage in Europe.

Another sign that China is moving to make the renminbi a global reserve currency is that, traditionally, CNH - the offshore version of the renminbi - has traded at a different foreign exchange rate to the CNY because of heavy regulation on the Chinese mainland. But that regulation has now eased and the rates have converged. The turning point of this convergence came when the PBOC widened the intra-day trading band on the onshore CNY exchange rate in April 2012.