|

|

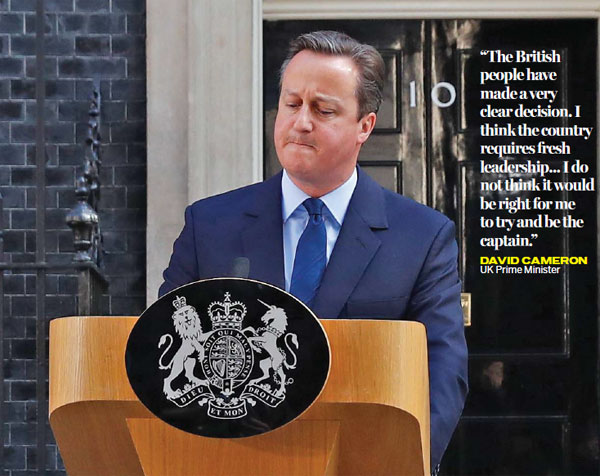

Britain's Prime Minister David Cameron speaks outside No 10 Downing Street in London on June 24 after Britain voted to leave the European Union. Stefan Wermuth / Reuters |

The UK's decision to vote in favor of leaving the European Union in a nationwide referendum on June 23 has already boosted the prices of precious metals. The prospects for both gold and silver over the coming years are bright. Nonetheless, Brexit alone may not be the game changer for the gold market that many anticipate.

The Brexit vote has led to a significant increase in economic and political uncertainty in the UK, with business confidence down and the prime minister on his way out. What's more, there are early signs of contagion to the rest of Europe. Populist parties in a number of other EU countries are already calling for referendums of their own.

Given this, it is not surprising that the price of gold has performed strongly since the referendum, reflecting both its traditional role as a global safe haven and the further scaling back of expectations for US interest rates. What's more, the price of gold has risen in dollar terms despite the broad-based strength of the US currency itself.

However, we should be wary of becoming carried away. The initial panic in the wake of the UK's shock referendum result has faded. Even UK equities have rebounded. In part this is because it has been recognized that the UK will not be leaving the EU immediately. There will be a negotiating period of at least two years, which should allow some of the uncertainties governing the UK's relationship with the rest of Europe to be cleared up.

Markets have also been reassured by changes in the official rhetoric. In the run-up to the referendum, officials favoring a vote to remain had a clear incentive to emphasize the risks of Brexit in order to try to influence the outcome. But after the vote, the focus of policymakers has shifted toward trying to reassure businesses and investors. In particular, central banks, led by the Bank of England, have signaled a willingness to cut interest rates further.

This is a mixed backdrop for gold. Safe-haven demand is likely to fade if the worst fears over the impact of Brexit are proved wrong. However, an extended period of ultra-low interest rates would clearly be favorable. Indeed, government bond yields are now negative in much of Europe and in Japan, increasing the relative appeal of gold.

Looking ahead, the markets have probably gone too far in expecting the Federal Reserve to leave US interest rates on hold for at least the next 12 months. The reality is that the global financial system has weathered the Brexit shock much better than many had anticipated. In the meantime, the US economy is gathering pace again and domestic wage and price pressures are building. We would not expect gold to revisit its previous highs of around $1,900 per ounce in 2011, unless the wider fallout from Brexit is so bad that the Fed is actually forced to loosen monetary policy again.

Nonetheless, gold has once again demonstrated its value as a safe haven. This is important and means that any pull-backs are likely to be temporary. Indeed, other potential shocks lie ahead, including the prospect of political uncertainty ahead of the US presidential election in November. There is also a significant risk that contagion from Brexit to the rest of the Europe will prompt a resurgence of the debt crisis in the eurozone, or even speculation that other countries will break away from the EU too.

But even if demand for safe havens does fade, the downside for gold will likely be limited by a renewed focus on the risks of higher inflation after years of exceptionally low interest rates.

The author is chief global economist & head of commodities research, Capital Economics Ltd.