Component firms are being squeezed by domestic brands and cut-throat pricing war

High-tech Chinese companies that make components for major global smartphone brands, such as Samsung, Apple and Nokia, are struggling to stay afloat.

Hit by dwindling profits, original equipment manufacturers, or OEMs, have faced a tough operating climate since the end of last year.

"Most Chinese electronics companies are now living at the very bottom of the industrial chain, despite decades of development," Liang Zhenpeng, an independent senior home appliances and IT analyst in Beijing, said. "They live on meager profits."

"What is worse, they are totally reliant on one single customer, which means they will find it very hard to carry on once the market declines," Liang added.

The depth of the downturn for OEM companies, which are mainly based in the Pearl River Delta and Suzhou in Jiangsu province, is starting to reach a critical point.

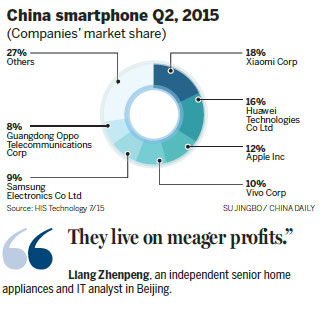

They are being squeezed by cheap domestic smartphone brands that manufacture their own components, stagnant mobile sales in China and the rest of the world, and cut-throat price cutting.

To illustrate the extent of the slump, Honghui Technology Co Ltd in Suzhou, which used to be a major supplier of Nokia Co and makes touch screens, once had a 10,000 strong workforce a few years ago. Last November, it laid off most of its employees and suspended production after Nokia revamped its struggling global smartphone business.

A month later, Wintek Corporation, the largest liquid crystal display, or LCD, manufacturer in Taiwan, shut down two of its subsidiaries in Dongguan in South China's Guangdong province.

The decision was quickly followed by the announcement that Wintek's subsidiary in Suzhou, which used to be the largest OEM in the city, would also close. Nearly 10,000 workers were made redundant by the move, with the fallout rippling through the entire industry.

Wintek is a major supplier of Apple Inc, the iconic smartphone and tablet maker in the United States, and Samsung Electronics Co Ltd, the South Korean giant.

The closures were the result of Wintek's "internal structural adjustment", the Dongguan government announced. "It's normal for factories to close if sluggish demand has affected their operations," Mayor Yuan Baocheng told China Daily earlier this year.

In June, BKSE Bokwang Suzhou E&T Co Ltd, the largest printed board assembly OEM company for Samsung, told employees at the Wujiang plant in Suzhou they would have to take a one-week vacation. But the factory never opened up again.

Even the administrative body at the Wujiang Economic and Technology Development Zone, where the company was located, was stunned by the decision. "It was a shock," Zheng Yi, deputy director of the administrative committee of the zone, said.

It was a similar story at BKSE's Dongguan factory in Guangdong province. The company told its workforce to take one-month's unpaid leave until August 1 after Samsung suddenly canceled its orders for LCD screens.

The factory has so far failed to reopen. No one at the company was prepared to comment about the decision to close the factories.

"With the waning advantage in human resources in the eastern parts of China and the acceleration of technology upgrading, more OEM companies will face a similar crisis in the near future," Liang, the independent analyst, said.

Even the major players in the market are in trouble. Foxconn Technology Group, the world's largest OEM company, announced at the beginning of 2015 that they would cut jobs due to a shrinking revenue and rising labor costs.

Foxconn has yet to release the exact number of redundancies, or a timetable for its decision to downsize, but it will happen later this year, company spokesman Louis Woo said.

Since 2013, Foxconn's factory in Kunshan in Jiangsu province has laid off 50,000 staff from the 110,000 work force.

"The slowdown of the smart device market and decreasing prices of smart equipment are the main reasons behind the decision," Woo said. "Even though technology has advanced, prices are going down. We have to accept this. So should our customers."

A key issue fueling the slump is that the Chinese mobile phone sector is starting to shrink. Numbers released by market consultancy IDC showed that a total of 98.8 million smartphones were sold in the first quarter of this year, a fall of 4 percent compared to the same period in 2014, and 8 percent on a quarterly basis. This was the first time the sector had contracted in six years.

Overall, sales of smart devices, which include mobile phones, tablets and PCs, have slowed in 2015. IDC reported that a a total of 514 million units were sold so far this year, up 1.3 percent. Last year's growth rate was 15.2 percent.

"This year we will witness the Chinese smart devices market entering its 'new normal', which means it will grow at a much slower pace," Mu Chen, senior market analyst at IDC, said.

Unfortunately, that could mean the "best years for Chinese OEMs are over", according to Zhang Yansheng, secretary-general of the academic committee of National Development and Reform Commission.

"China will hardly become a world's leading manufacturing country if it still relies on OEMs to handle one production procedure or one part of the device," Zhang said at a forum in Nanjing in Jiangsu province earlier this year.

"The time when China was simply about low prices has gone. Simple imitation, or copying, will not survive, especially under the 'new normal'. Companies that fail to innovate are sure to die."

shijing@chinadaily.com.cn

|

Workers on a smartphone touch screen production line at a factory in Liuyang, Hunan province. Provided To China Daily |

|

Many of China's original equipment manufacturers, or OEMs, face difficulties as they are being squeezed by cheap domestic smartphone brands that make their own components, stagnant mobile sales in China and rest of the world, and cutthroat price wars. Provided To China Daily |

(China Daily 09/07/2015 page13)

A US citizen comes to East China to help with clean-environment initiatives.

One of the potentially most traumatic things a girl has to go through is finding a new hairdresser.