Asian investors, fasten your safety belts

Updated: 2007-08-29 07:12

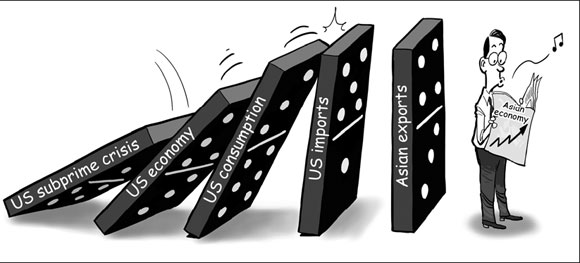

Investors have now begun to appreciate the importance of the US financial crisis and its effect on the Asian economy. For those hoping that the worst is over, I have news from America: You ain't seen nothin' yet.

The outlook for the US economy is bleak. It is increasingly difficult to tell a story that does not involve a recession, or at least a very significant economic slowdown, in the next 12 months.

The US housing bubble has burst. This is not exactly news, of course. Existing home sales had dropped by 20 percent from their peak even before the most recent bout of financial turmoil. New home sales have declined by 40 percent. The inventory of unsold homes has already exploded.

Last week's disappointing consumer confidence numbers from the University of Michigan clearly signaled this fact. Those numbers surely loomed large in the Fed's extraordinary intra-meeting discount-rate cut last Friday.

The threat to US growth is not simply that non-residential investment will tank now that corporations in other sectors are finding it more difficult and costly to borrow. It is that the growth of private consumption will now slow sharply. And private consumption accounts for more than 70 percent of US demand.

If the "consumer of last resort", the American household, now goes on strike, this will have serious implications for other countries and for Asia in particular.

There has been much talk in the last year of "decoupling"- of whether Asia can keep growing if US growth stops. The idea is that Asia now has an independent growth pole in China. And, with the Japanese economy doing better than it has in a decade, Asia can keep dancing even when the American music stops.

Nothing could be more wrong. Half of all Chinese investment is in the export sector. And those exports are heavily destined for the United States. Thus, Chinese economic growth will inevitably be affected by the US economic slowdown.

This also means a slowdown in Japanese growth and even the return of deflation.

The implication is that all of Asia should prepare for a significant economic slowdown. The impact of US troubles will be more immediate still.

In offering this gloomy forecast, I like to think that I am not simply joining the latest pessimistic bandwagon.

Full disclosure requires acknowledging that we anticipated that those problems would be accompanied or even precipitated by a sharp drop in the dollar. So far, however, problems have centered in the markets for collateralized debt securities and commercial paper, not the market for foreign exchange.

Investors have not fled the US for other countries, or caused the dollar to tank. But it is still too early to dismiss this risk. Foreign investors, including central banks, have been diversifying out of US treasury bonds into mortgage-backed securities and the US stock market.

These investments now look less attractive in light of recent developments. And if these alternative investments look dicey, diversifying out of US treasuries will require diversifying out of dollars.

The result will be a sharply lower dollar, which will be more bad news for Asian exporters.

The Korea Herald/ANN

|

|

|

||

|

||

|

|

|

|