With high risk and cheap stock, will Bear be sold?

(Agencies)

Updated: 2008-03-15 10:40

Updated: 2008-03-15 10:40

PHILADELPHIA - The emergency rescue of Bear Stearns Co Inc (BSC.N) on Friday left observers from all quarters wondering who would be the last man standing at the Wall Street bank.

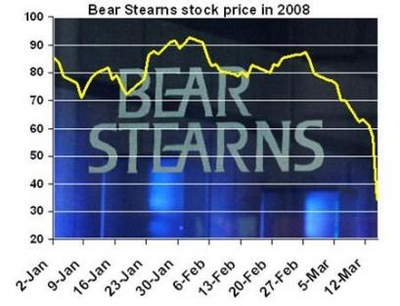

Bear Stearns, the fifth largest U.S. investment bank, on Friday said a cash crunch forced it to turn to the Federal Reserve and JPMorgan Chase for emergency funds, intensifying fears of a widening global credit crisis and driving its shares down as much as 50 percent. [Agencies] |

When a Bear Stearns analyst moved to ask a question at a biotechnology investor meeting, Genentech Chief Executive Arthur Levinson quipped, "There's still somebody here from Bear? Let's give him a hand."

"I'm still here," said Bear Stearns analyst Mark Schoenebaum. But pointing to a JPMorgan analyst, he said, "I think I work for Geoff Meacham now."

The rescue by JPMorgan Chase & Co (JPM.N) and the Federal Reserve Bank after Bear said its cash position had deteriorated sharply put the word takeover on the tip of tongues all over Wall Street, with JPMorgan seen as a leading contender to buy out Bear Stearns.

But while Bear's cheap stock price could attract some suitors keen to buy its mortgage finance and trading assets, its liquidity problems may prevent a deal from being consummated, analysts and bankers said.

Shares of Bear Stearns, the fifth largest US investment bank which has been hard-hit by its heavy exposure to the faltering U.S. mortgage market, fell 45 percent, reducing its market value by $3.2 billion to $3.64 billion.

Bear Stearns Chief Executive Alan Schwartz said the company is working with Lazard Ltd (LAZ.N) to examine its alternatives, but it will focus on protecting customers and "maximizing shareholder value."

He said Bear's first-quarter earnings would meet Wall Street expectations.

CNBC reported that Bear Stearns "is actively being shopped." While JPMorgan is "the most likely suspect," CNBC said it was not the only company to receive a pitch to buy the company.

"Our view is it would not be a surprise to see a merger announced over the weekend," said Andrew Brenner, senior vice president of MF Global in New York.

A person familiar with JPMorgan said the bank, which has previously expressed interest in expanding its prime brokerage business, is interested, at the right price, in buying the Bear division that provides loans and handles trades for hedge funds.

The concern for any buyer would be whether Bear Stearns has fully exposed all of its problems or if there is another debacle in the offing.

"Looking from the outside you have to ask, Are they at the end of their troubles? That's a very difficult question," said Anthony Sabino, professor of law and business at St. John's University, in New York.

|

||

|

||

|

|

|

|