|

|

|

|

|||||||||||

|

|

|

Major food companies, such as Bright Food Group Co, maker of the popular White Rabbit candy, have shown interest in expanding overseas and purchaseing assets, especially in the dairy, wine and sugar industries. [Photo / Bloomberg] |

Global food and beverage companies are likely to be the next major targets for Chinese enterprises pursuing overseas mergers and acquisitions, since tough global economic conditions are creating takeover opportunities.

Major domestic food and beverage companies, such as COFCO Group and Bright Food Group Co Ltd, have shown great interest in expanding overseas and purchasing assets, especially in the dairy, wine and sugar industries.

Bright Food, which runs China's biggest sugar production and distribution business and operates Bright Dairy, an industry leader, is negotiating with a French wine company about a potential acquisition, according to Ge Junjie, vice-president of Bright Food.

Ge declined to identify the French company but said talks were going well.

"Bright Food is determined to be a global player. We hope to introduce the world's premium foods to the Chinese mainland, where demand is huge," said Ge.

He commented on the sidelines of the annual session of the Chinese People's Political Consultative Conference in Beijing.

Ge said Chinese people are displaying stronger demand for safe, high-quality food as their incomes rise and as they become more aware of safety issues.

The global economic downturn has created an "extremely good opportunity" for Chinese buyers, according to Ge. He said that in the past one to two years, many foreign food companies had contacted Bright Food to discuss potential cooperation.

"It's a good thing for both sides. China's big market and Bright Food's strong distribution network lure them. Meanwhile, they can help Bright Food extend its lead in China and tap overseas markets," said Ge.

Shanghai-based Bright Food has completed two overseas acquisitions so far. In 2010, the company purchased a controlling stake in New Zealand's Synlait Milk for $58 million. On Aug 17, 2011, Bright Food agreed to spend $382 million for a 75-percent stake in Manassen Foods Australia Pty, an Australian branded food business.

Another Chinese food giant, COFCO, made its first overseas purchase in 2010 by acquiring Chilean winery Biscottes for $18 million. It then purchased a 99-percent stake in Australian sugar producer Tully Sugar for $145 million in July 2011.

Hangzhou Wahaha Group Co, China's top beverage producer, plans to invest in dairy farms in Western Australia to expand its import channel for milk, Chairman Zong Qinghou told China Daily earlier this week.

But while Chinese companies' enthusiasm for purchasing overseas assets is rising, the actual level of outbound investment is still small.

In China's food and beverage industry, the total number of M&A deals was 221 from July 2008 to June 2011, according to a research note from ChinaVenture, a leading investment consultancy company in China. But only eight cases, or 4 percent, involved overseas targets.

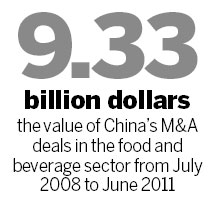

China's M&A transactions in the food and beverage sector reached $9.33 billion in the same period. But outbound M&As accounted for merely 1 percent of the total, the note said.

"For Chinese companies, when they make M&As abroad, they mainly focus on upstream resources and their major purpose is to lift market share in the Chinese market," said Fiona Wan, an analyst with ChinaVenture.

"Because they haven't shown an ambition to conquer the global market their overseas transactions have been relatively small," said Wan.

Zhang Yanan, an analyst with Beijing-based research firm Zero2IPO Group, said that Chinese investment in food and beverage companies overseas was set to surge.

"The food consumption structure is changing in China, as people ask for more premium foods. Meanwhile, the timing is good for domestic food companies, and they've already gained some experience in purchasing assets overseas," said Zhang.

The road for expansion may not be smooth, Zhang added. Bright Food, before it completed deals in New Zealand and Australia, experienced four failed attempts in buying assets overseas.

"This is only the start of Bright Food's globalization. Our company will definitely conduct more deals focusing on our main businesses, such as dairy, sugar and wine," said Ge.

shenjingting@chinadaily.com.cn