|

|

|

|

|||||||||||

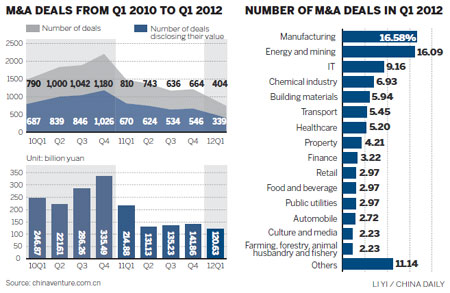

The number of completed merger and acquisition deals decreased by 50 percent year-on-year in the first quarter of 2012 amid the global economic slowdown, suggests a report.

The report, by China Venture Group, a Chinese private equity research agency, said most mergers and acquisitions involving Chinese enterprises are now occurring in the energy and mining industries.

"Because of the global economic recession, there were fewer mergers and acquisitions in the first three months," Wan Ge, author of the report and an analyst at China Venture Group, said on Wednesday.

"But, if historical performances are any indication, the number of deals in the following quarters will increase steadily."

The first three months of the year saw only 404 finished merger and acquisition deals, 50 percent fewer than in the same period last year. Details related to 339 of those were disclosed, showing that they had a total value of 120.6 billion yuan ($19.2 billion), a decrease of 43.9 percent year-on-year, the report showed.

The first quarter saw 65 deals completed in the energy and mining industries. Those were valued at 55.9 billion yuan and accounted for 46 percent of the total value of such deals in that period.

The industries' trade value was much larger than that of manufacturing, which was the second largest industry in the ranking and took up only 7 percent of the total.

"China has a huge demand for energy and positively goes abroad to seek opportunities," Wan said. "Usually, Chinese buyers are State-owned enterprises with enough money. So the trade value of these deals is considerable."

The largest energy and mining deal among the 65 came when China National Offshore Oil Corp Ltd, the country's biggest marine oil producer, announced in February that it would close on sale and purchase agreements brokered with the British oil firm Tullow Oil PLC. The agreements will enable the company to purchase a one-third interest in each of Tullow's three exploration areas in Uganda. The transaction was valued at about $1.47 billion in cash.

The number of deals that were started in the first quarter of 2012 also decreased to 712, down 40.6 percent from the same period last year. There were 576 deals that have disclosed their trade value, which came to 345 billion yuan, a 2.4 percent drop year-on-year.

Domestic merger and acquisition deals made up 87 percent of all of the deals involving Chinese enterprises in the first quarter, Wan said.

Even so, China's outbound merger and acquisition deals, though making up a smaller percentage of the total, are expected to increase in the years to come, said a report by the professional services firm Deloitte Touche Tohmatsu Ltd on Wednesday.

China's investments in emerging markets, including Brazil, Russia, India and South Africa, in particular, are likely to increase further as the country looks to tap overseas resources and expand its global presence, according to the report.

"Chinese investment enthusiasm into these countries has remained strong as economic growth in these, and other emerging markets, has remained relatively intact despite global uncertainty," said Lawrence Chia, co-chairman of Deloitte China's Global Chinese Services Group.

Between 2007 and 2008, Chinese enterprises made 43 deals in Brazil, Russia, India, and South Africa having a total value of $6.3 billion. From 2010 to 2011, that increased to 54 deals worth $23.7 billion.

Among all of the country's outbound merger and acquisition deals, the energy and resources industries also made up the largest proportion, accounting for 95 percent of the total value of the deals, the report said.

Chia said energy and resources will continue to make up the biggest percentage of Chinese merger and acquisition deals made across borders. Even so, other industries, such as manufacturing and consumer products, will take on greater weight as they expand globally, he added.

Contact the writers at caixiao@chinadaily.com.cn and chenlimin@chinadaily.com.cn