1st forex quarterly decrease in decade

Updated: 2012-01-14 08:54

By Wang Xiaotian and Li Tao (China Daily)

|

|||||||||||

Drop reflects outflow of foreign capital amid global economic woe

BEIJING / HONG KONG - China's foreign exchange reserves declined on a quarterly basis for the first time in more than a decade, a sign analysts said underpins the need for the country to shore up market liquidity.

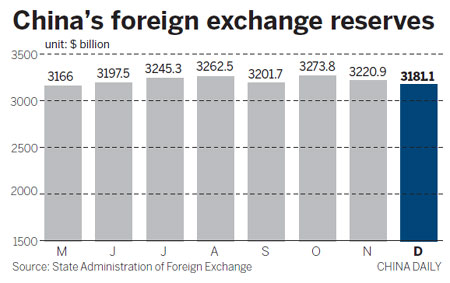

The world's largest holdings of foreign wealth fell to $3.18 trillion at the end of last year from $3.2 trillion at the end of September, according to data released on Friday by the People's Bank of China, the central bank.

The value of the portfolio dropped in November and December, the first consecutive monthly fall since the first quarter of 2009, because of a shrinking trade surplus and accelerating capital outflows.

Trade surplus and foreign direct investment are the two major contributors to foreign exchange reserves.

"The change from a monthly drop to a quarterly fall points to an accelerated outflow of speculative capital, as the European debt crisis worsens," said Ding Zhijie, dean of the School of Banking and Finance at the University of International Business and Economics in Beijing.

In September, the reserves witnessed the first drop for a single month in 16 months by shrinking $60.8 billion, but by the end of the third quarter the total value had still increased compared with three months earlier.

Chinese banks' yuan positions for foreign exchange purchases, an indicator of capital flows, fell for the first time in four years in October, and declined consecutively in November and December, according to the central bank.

The figure dropped by more than 100 billion yuan ($15.8 billion) in December, compared with a decline of more than 20 billion yuan in October and November.

"Declines in foreign reserves and yuan positions reflect the fluctuation of the foreign exchange market as the debt crisis in the eurozone is prompting investors to sell their emerging market assets," Ding said.

Kevin Lai, analyst with Daiwa Capital Markets, said money outflows from China will continue this year due to expected slower economic growth and higher macroeconomic risk.

"Together with a slowdown of foreign direct investment, we are likely to see a decline of foreign exchange reserves through the year."

The decline in Chinese foreign reserves has drained money from the domestic market, said Yao Wei, China economist at the French bank Societe Generale SA.

The People's Bank of China said last week that it will suspend sales of central bank bills and conduct reverse repurchases before the Chinese New Year on Jan 23, moves that allow banks to have more money to lend.

The announcement significantly reduced the probability that China would cut the required reserve ratio for banks - another instrument often used to boost liquidity - in the next two weeks, Yao said.

Required reserves are the money commercial banks have to hold as a guarantee. A reduction of the required reserve ratio means commercial banks have more money to lend.

"Capital outflows from China reflect the change of the direction of global capital flow in the past two or three months seeking safe haven in the US dollar," said Qu Hongbin, chief China economist and co-head of Asian Economic Research at HSBC.

The departure of foreign money will also stymie liquidity in China and the central government may need to further ease its monetary policy then, he said.

"Following December's 50-basis point cut in the required reserve ratio, authorities will free more cash for banks to increase lending, as already seen in December's money supply data," said Matthew Circosta, economist at Moody's Analytics, a subsidiary of Moody's Corporation.

A total of 640.5 billion yuan in loans were lent out in China in December, an amount higher than expected, while M2, a broad measure of money supply, rose by 13.6 percent.

Circosta said China will still allow the yuan to appreciate to placate China's trading partners, but at a slightly slower pace than in 2011, to support manufacturing and export growth.

Related Stories

Digging out of the foreign exchange reserves 2011-08-02 10:48

Foreign exchange reserves hit record high 2011-01-12 07:58

Official defends foreign reserves 2011-12-03 07:50

Bloated forex reserves drag on economy 2011-08-12 11:01

- China targets 10% foreign trade growth

- Hebei to build large offshore wind farm

- Antitrust filings rise 49% in '11 in China: MOC

- Lottery sales growth slows in China

- Shipbuilding orders slump on downturn

- First forex quarterly decrease in decade

- US urges closer ties with China

- Outbound M&A hits record high