China's sovereign wealth fund banks on diversified investment approach

At first glance, the nondescript building in downtown Beijing does not even merit a second look. But very few know that behind the glass facade is the office of China Investment Corp, the country's sovereign wealth fund that has $575 billion in assets and invests predominantly in overseas markets.

There is no sign of wealth or rich trappings, and the sparsely furnished walls, or the corner office of the chairman and the spartan furniture that dot the premises give the distinct feel and flavor of an ordinary government office in China. On any given day it is common to see groups of people dressed in suits huddled over piles of balance sheets and maps of Europe and Africa holding forth on the state of the economy, investment options and pricing strategies. Within these walls lie the rich talent pool or the real wealth that is helping CIC achieve stable, assured returns through its diverse investment mixture.

Ding Xuedong, the new chairman of the sovereign wealth fund, had recently remarked that these are indeed tumultuous times for the global financial markets, as there are several uncertainties. While most of the sovereign wealth funds such as Temasek of Singapore and the Government Pension Fund of Norway still prefer asset-backed investments, CIC goes for a more pragmatic approach and diverse investment portfolio.

According to fund officials, CIC's main objective is to make more money from its overseas investments and generate additional capital for investment.

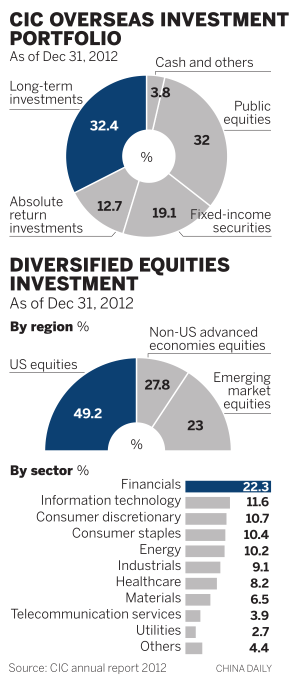

Adjustment of the investment portfolio and the higher equity prices saw the fund post robust returns last year, especially from the long-term assets in global markets. CIC posted a 10.6 percent gain on its global investments last year, compared with a 4.3 percent loss in 2011, according to the company's annual report. The cumulative annualized return of CIC's overseas investments rose to 5.02 percent by the end of last year, from 3.8 percent in 2011. Net income rose to $77.4 billion from $48.4 billion in 2011, the report said.

Fund officials say that such a good performance has been possible due to the fund's diverse approach. "It enabled us to adjust our investment portfolios in line with the higher equity prices in global markets last year," a CIC official says.

During the same period, Temasek of Singapore achieved returns of 1.5 percent, while the Norway fund came in with 13.4 percent. Other wealth funds such as Singapore's GIC and the Abu Dhabi Investment Authority are yet to publish their earnings numbers.

"When you look at these numbers, you can see that 10.6 percent is a good return on investment for a sovereign wealth fund," says Victoria Barbary, director of Sovereign Wealth Center, a London-based market intelligence company.

Meanwhile, at the fund offices in Beijing, it is working as usual. CIC knows that it cannot afford to rest on its laurels. "The fixed-asset strategy boomeranged in 2010 after our Morgan Stanley equity investments sharply eroded in value," the unnamed fund official says.

"Our losses were in the region of $115 million. We also faced a lot of umbrage for staying invested in overweight US Treasury bonds. It was then that the fund decided to broaden its investment portfolio from financial products to infrastructure and industrial projects, and also from North America to Europe and emerging markets in Asia and Africa."

Barbary says CIC's shift toward an endowment model is also an indication that the fund is not too sure of receiving future funding from the People's Bank of China, the central bank. Since the fund's launch, the State Administration of Foreign Exchange, which manages the country's $3.5 trillion foreign exchange reserves, has given it only an additional $49 billion to invest abroad. With further capital injections uncertain, CIC is increasing its exposure to assets that yield fairly predictable short- and long-term cash flow for reinvestment, she says.

Shanghai inaugurates Free Trade Zone

Shanghai inaugurates Free Trade Zone

New BMW 5 Li hits Chinese market

New BMW 5 Li hits Chinese market

China to officially launch Shanghai FTZ on Sept 29

China to officially launch Shanghai FTZ on Sept 29

Time to get smart

Time to get smart

Leaders' car picks around the world

Leaders' car picks around the world

Shining models at 15th Aviation Expo China

Shining models at 15th Aviation Expo China

2013 Beijing Intl Jewelry Expo kicks off

2013 Beijing Intl Jewelry Expo kicks off

Microsoft revamps Surface to challenge Apple

Microsoft revamps Surface to challenge Apple