CNPC plans steady overseas expansion

Updated: 2011-10-21 08:42

By Zhou Yan (China Daily)

|

|||||||||||

|

|

|

A China National Petroleum Corp booth at an exhibition in Beijing. The company's overseas oil and natural gas output is expected to reach 100 million tons of oil equivalent this year. [Wu Changqing / For China Daily] |

BEIJING - China National Petroleum Corp (CNPC), the country's biggest energy company by production, said on Thursday that its overseas expansion will continue to focus on the upstream division with Canada and Australia as the major targets.

CNPC's overseas oil and gas output is expected to reach 100 million tons of oil equivalent this year, of which equity-based production will account for 50 percent, according to Jiang Jiemin, the company's general manager.

In 2010, the energy conglomerate's overseas oil and gas output stood at 86.73 million tons.

"Our company's foreign sales and profits will both hit a record high this year," Jiang said. He added that CNPC plans to continue to rapidly and consistently expand overseas and that it regards Canadian and Australian assets as its top priorities because of the two countries' abundant natural resources and steady investment environment.

|

PetroChina, the listed arm of CNPC, joined Royal Dutch Shell last year to acquire Australia's coal-bed methane developer Arrow Energy Ltd for A$3.3 billion ($3.38 billion). The company also planned to pay CN$5.4 billion ($5.3 billion) for a 50 percent stake in a natural gas field in Canada owned by the local oil and gas maker Encana in February, but the deal collapsed in June.

"The assets that we highly value are liquefied natural gas resources in Australia, for the shipment convenience, while in Canada, we mainly focus on the unconventional natural gas resources," said Wu Mouyuan, an engineer with the Overseas Investment Environment Research Department under CNPC's research institute.

CNPC's rival China Petrochemical Corp, the nation's biggest refiner, announced it would purchase Canada's Daylight Energy for CN$2.2 billion in October to gain shale gas reserves in the country. That follows China National Offshore Oil Corp's acquisition of Canadian oil sands producer OPTI Canada Inc in July for $2.1 billion.

China's natural gas demand has grown rapidly in recent years, said Jiang. He said that the country's demand for the fuel will be 20 percent higher this year than in the previous year. "The market will grow much bigger in the future," he said.

To fill the gaps in supply, China has been in talks with Russia since 2006 to obtain 68 billion cubic meters (cu m) of natural gas annually for 30 years. Jiang, who is also chairman of PetroChina, said that the price disparities in the deal were not resolved during Russian Prime Minister Vladimir Putin's visit to China in October. "There's no timetable for the talks yet," Jiang said.

In addition, Zhou Jiping, president of PetroChina, also said on Thursday that PetroChina's refining division will suffer losses of more than 50 billion yuan this year if fuel prices remain at the current level.

The company reported 23.3 billion yuan in refining losses in the first half of this year.

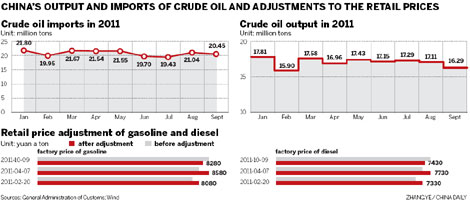

China announced on Oct 8 it would reduce the retail prices for gasoline and diesel by 300 yuan a ton, effective since Oct 9, the first such cuts in 16 months, despite the volatility of global crude oil prices.

Zhou also said that now is not the right time to let individual energy companies set fuel prices, given the country's high inflationary pressure. "It's still better to let the government control the prices," he said.

"We fully support the idea of letting the government improve the current fuel pricing scheme," Jiang said.

Jiang also said that the nationwide application of the resource tax reforms based on value rather than volume will cost the company 29 billion yuan a year, up 25 billion yuan from the previous tax regime, if the crude oil price stays at $100 a barrel and the natural gas price stays at 1.05 yuan a cu m.

Related Stories

Iran suspended a gas contract with CNPC 2011-10-18 18:01

China sets shale gas output targets 2011-10-12 16:09

CNPC terminates 6 overseas projects 2011-08-22 15:01

Hot Topics

Libya conflict, Gaddafi, Oil spill, Palace Museum scandal, Inflation, Japan's new PM, Trapped miners, Mooncake tax, Weekly photos, Hurricane Irene

Editor's Picks

|

|

|

|

|

|