|

|

|

|

||||||||||||||

|

|||||||||||

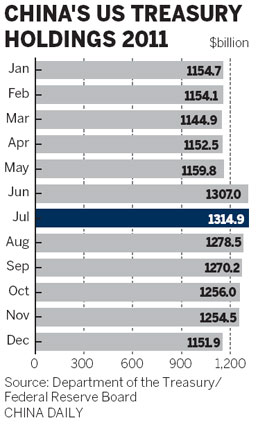

BEIJING - China has made the first annual reduction in its holdings of US Treasury bonds in a decade. Experts are viewing the move as a sign that the country is accelerating the move away from dollar assets in search of more diversified investment channels.

According to the latest monthly figures from the US Treasury Department, China's holdings of US Treasury bonds dropped for a fifth consecutive month in Dec to $1.15 trillion.

The number was an update of a figure released in February, after the US department adjusted its method of collecting data on foreign holdings of US government bonds, a move aimed at obtaining more information about the use of proxies buying and holding US securities.

As a result, China's June holdings of US Treasury securities have been amended to $1.31 trillion instead of $1.17 trillion. The figure at the end of 2011 was $51 billion higher than the previous calculation.

|

|

According to the revised data, China cut its holdings of US debt by $8.2 billion in 2011 compared with the previous year. It was the first time that the country had reduced its yearly holdings since 2001.

The country remains the largest foreign holder of US treasuries, but analysts suggest that China's $3.2 trillion in foreign-exchange reserves means that the country is beginning to rapidly diversify its portfolio of foreign currencies.

Senior Chinese officials, including the central bank governor Zhou Xiaochuan, have repeatedly emphasized the importance of diversification of China's foreign-exchange reserves to minimize the negative impact of fluctuations in the international financial markets.

The latest figure "clearly indicates China's intention not to put all its eggs in one basket", said Lu Feng, director of Peking University's China Macroeconomic Research Center, according to quotes in the Wall Street Journal.

"The Chinese government has reiterated that it will be actively involved in supporting the troubled euro area. With China's holdings of US debt declining, plans for Europe may be already in progress," said Shen Jianguang, chief Asia-Pacific economist with Mizuho Securities Co Ltd.

The reduction of dollar assets coupled with the ambitions in the eurozone can be interpreted as an important step by Chinese foreign-exchange regulators to promote the diversification of reserves, Shen said.

China has many reasons to reduce its exposure to the US dollar, such as low yields and the monetary-easing measures adopted by the US government, which could lead to inflation that could erode the value of those holdings, said Wei Liang, a researcher with the China Institute of Contemporary International Relations.

The increasing volume of outbound investment may also have indirectly affected the amount of money invested in US debt, Wei said.

"US debt has been a safe haven for capital amid the global economic crisis, but as we see growth come back on track, investors may pull out in favor of other investment channels," he said.

Wu Ying, iPad, Jeremy Lin, Valentine's Day, Real Name, Whitney Houston, Syria,Iranian issue, Sanyan tourism, Giving birth in Hong Kong, Cadmium spill, housing policy

|

|

|

|

|

|